What does it mean to know your ICP? Working with B2B SaaS organisations, I find that marketing and sales teams are not necessarily struggling to understand the market and the dynamics within it, but rather where to set their focus.

The symptoms would be familiar to many B2B SaaS marketers in a new role: inconsistent pipeline quality, conversion rate bottlenecks, and targeting that feels slightly off.

Analyse the root cause and the issue often comes back to the ICP and how the organisation defines it.

What is an ICP?

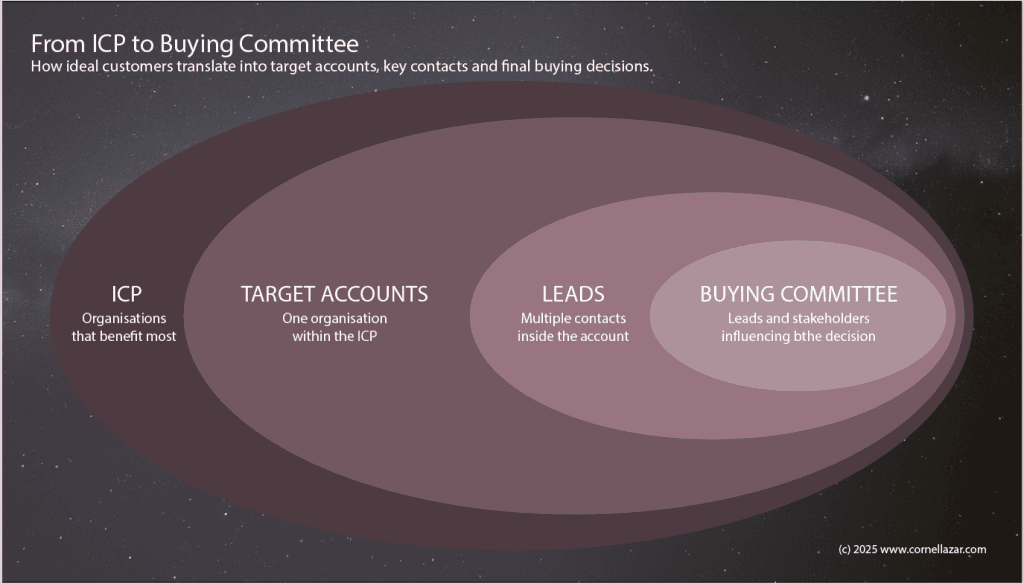

But before we jump in, let us align on what an ICP is, how it differs from a lead, and where your buying committee fits in. Who is part of it?

An ICP defines the organisations that gain the most value from your product. A target account is one of those organisations. A lead is a single potential buyer within it. The buying committee is the group who influence, approve, or use the solution.

I may preempt where the direction is going, but as we can already see, we are not marketing to an organisation. We market to individuals within that organisation, each with their own challenges, objectives and goals.

So, how do you build or define your ICP?

Collecting data is not the issue, but recognising which signals genuinely matter. Many teams start and end by over indexing on firmographics, ignoring behaviours, and misreading entire segments. It is these fundamentals that get overlooked.

My framework sets out how to define your ICP, built on understanding how individuals operate, what they prioritise, and how your solution or service can meaningfully improve their outcomes.

TL;DR

- Most ICPs fail because they rely on firmographics rather than actual customer behaviour.

- The strongest predictor of fit is the work a customer needs to do, not their industry or headcount.

- Start with the core use case your product supports.

- Understand which alternatives customers use and what problems those alternatives create.

- Validate fit using real data from product usage, commercial signals, and customer behaviour.

- Build your ICP in tiers and create an anti persona to prevent poor fit opportunities entering the pipeline.

- A clear ICP improves targeting, strengthens positioning, and increases go to market efficiency.

Why Most ICPs Miss the Mark

Many teams begin their ICP with firmographics. These criteria feel structured and objective, yet they rarely predict buying behaviour. Typical examples include:

- Industry

- Company size

- Geography

- Revenue band

The problem is simple. These elements describe a company, not the work it does. A business may meet every one of these criteria yet have no need for your product. As a result:

- Targeting becomes too broad.

- Conversion rates remain inconsistent.

- Pipelines fill with accounts that never buy.

- Teams spend too long qualifying companies that will never be ready.

Most organisations do not lack data. They lack clarity about what actually drives demand.

Just because a company fits your firmographic ICP does not guarantee they need your product.

Cornel Lazar

An ICP Rooted in Real Work and Real Demand

High performing teams define their ICP around the activities a customer must perform to gain value from the product. This shifts the ICP from a theoretical profile to a practical, immediately recognisable segment.

A strong ICP reveals:

- Who is already performing the core workflow.

Who plans to start performing it.

Who is dissatisfied with current approaches.

Who feels real friction or inefficiency.

When your ICP reflects real behaviour:

- Messaging becomes sharper.

- Sales conversations shorten.

- Qualification becomes faster.

- Demand generation becomes more predictable.

- Product marketing aligns naturally with customer reality.

You stop guessing who might buy and start focusing on those who undeniably need the outcome you provide.

10 step framework to identify your ICP

1. Begin With the Work Customers Need to Do

Firmographics Lead to False Signals

Relying on descriptors like industry or revenue creates the impression of clarity. In reality, these attributes rarely correlate with product usage or purchasing intent.

Workflow Reveals True Fit

The foundation of an ICP is the work the customer must perform. If they do not engage in this activity, they cannot benefit from your solution. If they do, their likelihood of buying increases significantly.

Teams over index on who the company is and under index on what the customer is actually trying to get done.

Cornel Lazar

Identify the Functional Activities Your Product Supports

Ask a simple question: What tasks do teams need to perform in order to use our product?

- For outbound sales tools, the work is outbound sales.

- For customer success software, the work is customer management.

- For BI tools, the work is business intelligence.

This work becomes the first and most important layer of your ICP and create natural, built-in markets. Your ICP begins with the people who are already doing that work.

For a complete ICP definition process that goes beyond firmographics, explore ICP for SaaS: A Practical Framework.

2. Anchor Your ICP in a Single, Clear Use Case

Assuming the Product Works for Everyone

Teams often believe their platform offers broad value. This mindset expands the target market beyond reality and weakens both positioning and messaging.

A Specific Use Case That Shapes Demand

A clear use case defines:

- What customers are trying to achieve

- What tasks they need to complete

- Where your product fits in their workflow

This reduces ambiguity and strengthens all downstream decisions.

Define the Primary Use Case First

Only after the use case is established should you layer in:

- Company type

- Team structure

- Role level

- Behavioural traits

- Organisational triggers

Use case comes first. Everything else follows. If you need a full step-by-step method to build your ICP from scratch, see my ICP for SaaS – Practical Framework.

3. Understand the Alternatives Customers Rely On

Treating All Prospects as If They Experience the Same Problems

Not all prospects face the same constraints. A company using rigid software will feel different tensions than a company using spreadsheets.

Alternatives Reveal Problems and Priorities

Understanding what customers currently use helps reveal:

- Operational inefficiencies

- Gaps in capability

- Frustrations with existing tools

- Workarounds that signal deeper needs

Map the Alternative and the Problem

For each use case, identify:

- The alternative solution

- The specific problem that alternative creates

- The urgency or impact of that problem

This strengthens qualification and highlights prospects most likely to convert.

If you want to operationalise these insights across your GTM motion, the structured approach in ICP for SaaS: A Practical Framework is helpful.

4. Build Your ICP Using Real Customer Data

ICP Decisions Driven by Internal Opinions

Teams often define ICPs by guessing or debating internally. Assumptions get recycled and rarely align with real customer behaviour.

Evidence Based ICP Development

Look across your customer base and identify patterns using:

- Product usage behaviour

- Feature engagement

- Support interactions

- Commercial outcomes

- Renewal and churn patterns

- Integration adoption

- NPS and sentiment

- Sales cycle dynamics

Combine Quantitative and Qualitative Inputs

- Useful sources include:

- Sales conversations

- Customer interviews

- Onboarding feedback

- Win and loss insights

- Billing and contract data

The strongest ICPs surface when multiple signals point to the same set of customers.

The hardest part of defining your ICP is not gathering more data. It is knowing which signals genuinely matter.

Cornel Lazar

5. Apply First Layer Segmentation

A Single, Undifferentiated Customer Pool

Without segmentation, no team can reliably target or prioritise. Everyone looks like a potential customer.

Basic Filters Provide Initial Structure

Helpful early segmentation categories include:

- Industry

- Tooling

- Team size

- Geography

- Internal organisational setup

Use These Filters to Narrow, Not Finalise

This layer screens out clearly poor fit segments but does not define the ICP on its own. It reduces clutter so deeper segmentation can happen effectively.

6. Introduce Deep Dive Segmentation

Stopping Too Soon and Missing Behavioural Insight

Teams often stop after basic descriptors and fail to capture the complexity of real buying patterns.

Behavioural and Contextual Insights Reveal Stronger Fit

- Advanced segmentation considers:

- How often customers use the product

- Whether they focus on a single use case or multiple

- Whether the champion is a manager or contributor

- Budget ownership patterns

- Pressures caused by hiring constraints or cost control

- Stage of organisational maturity

- Operational complexity or workflow volume

Build Layers That Reflect Real Behaviour

This deeper segmentation produces customer groups that match both demand and product value.

7. Identify Your Best Fit Customers

Large Volume Masks What Truly Matters

Teams often assume the most common customer type is the best fit. Yet volume is not the same as value.

A Tiered ICP That Reflects Fit and Potential

Strong ICPs often include three layers:

- Primary ICP: the segment with the highest fit and best outcomes

- Secondary ICP: segments with potential but less consistency

- Expansion ICP: long term opportunities with weaker signals today

Evaluate Fit Using Performance Patterns

Look across:

- Conversion rates

- Deal velocity

- ACV

- Retention strength

- Expansion potential

- Sentiment and advocacy

Patterns will reveal the customers who thrive with your product.

8. Create a Clear-Anti Persona

Teams Waste Time on Poor Fit Leads

Without disqualification criteria, pipelines fill with prospects that drain time and resources.

An Anti Persona Protects Time, Budget, and Focus

An anti persona outlines the traits of customers who consistently:

- Fail to convert

- Convert slowly

- Churn early

- Block adoption

- Require excessive support

Document Red Flags Based on Evidence

Include indicators such as:

- Lack of workflow

- Lack of ownership

- No current alternative

- Low operational urgency

- Misaligned expectations

This improves sales efficiency and reduces CAC.

For examples on how to validate and prioritise your ICP tiers in a SaaS environment, check out my ICP for SaaS – Practical Framework.

9. Use Cases and Categories Create Natural Markets

Persona Led Targeting Creates Guesswork

Personas focus on descriptors, not behaviours. They fail to predict who will value the solution.

Use Cases and Categories Anchor Teams in Reality

Use case based markets define:

- What work someone is trying to complete

- What category they shop for

- What outcome they want to achieve

Category based markets define:

- The type of solution customers expect to compare

- The problem space your product naturally sits within

Start With Use Case or Category, Then Enhance With Firmographics

This combination produces an ICP that is:

- Clear

- Actionable

- Easy for teams to understand

- Simple to apply across sales, marketing, and product

If you want a step-by-step ICP framework that turns this use-case thinking into a full process, see ICP for SaaS: A Practical Framework.

10. Bringing It All Together

A strong ICP emerges from a combination of:

- The work the customer needs to do

- The primary use case your product supports

- The alternatives customers rely on

- The problems caused by those alternatives

- Quantitative performance data

- Behavioural and contextual segmentation

- Clear signals of best fit

- Clear indicators of poor fit

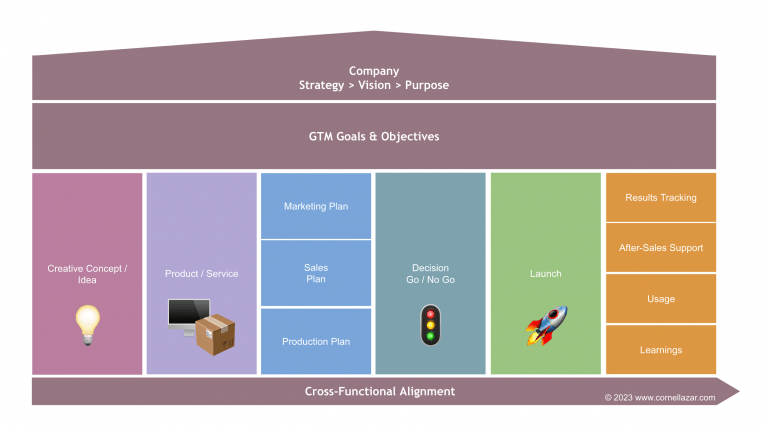

When teams define their ICP this way, they gain:

- Sharper targeting

- Stronger messaging

- Faster qualification

- Lower acquisition costs

- Shorter sales cycles

- Healthier retention

- More predictable growth

A well defined ICP is not a document. It is a decision making tool. It aligns teams, clarifies focus, and transforms go to market execution.