SaaS Demand Gen trappings

Most SaaS teams are busy. Campaign calendars full. Paid budgets deployed. Webinars booked. SDRs pushing through lists. Lead numbers look healthy on paper.

Yet pipeline feels thin. Forecast calls feel tense. Sales complain about timing and fit. Marketing defends the numbers. Leadership wonders why revenue is still so unpredictable.

It’s not that teams are doing the wrong things. It’s that they’re using the wrong mental model. Lead generation pushes you to optimise for contact capture. But contact capture tells you nothing about a buyer’s readiness to move, commit or buy.

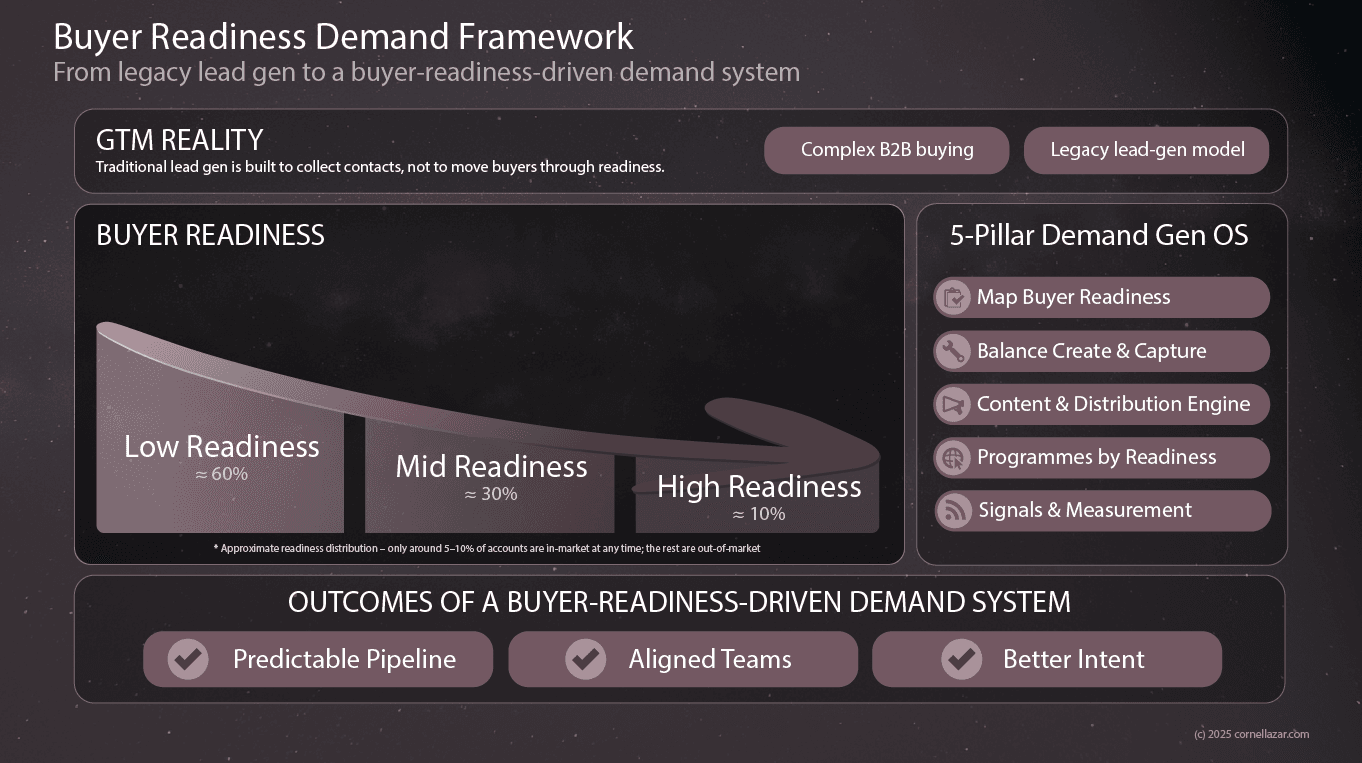

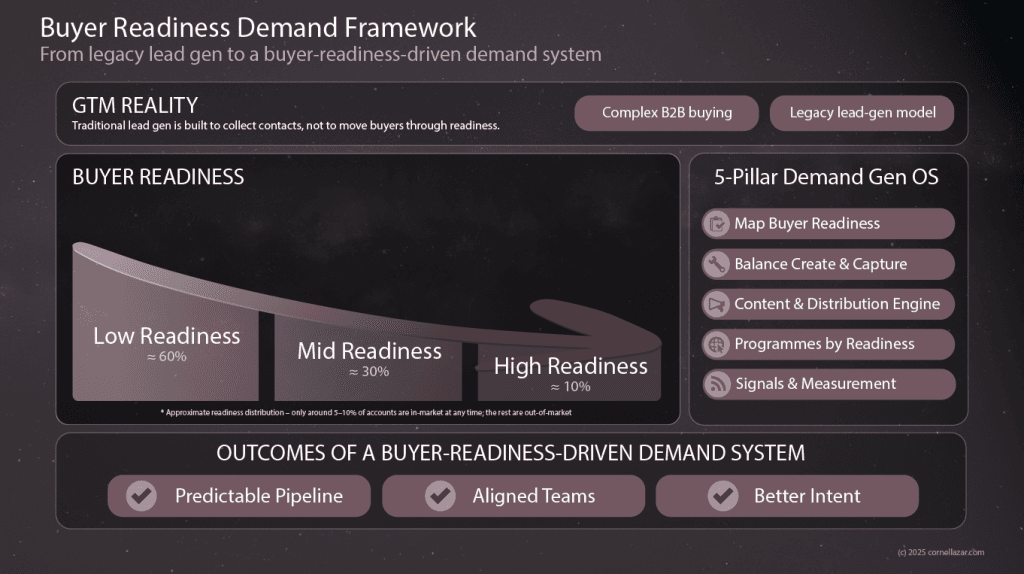

This article introduces a simple way to change the lens: the Buyer Readiness Demand Framework – a demand gen framework for SaaS that aligns your GTM engine with how buyers actually behave.

TL;DR

SaaS teams often chase lead volume, but those signals rarely translate into reliable pipeline.

Buyers move through low, mid and high readiness, not neat funnel stages. Most aren’t actively buying.

The Buyer Readiness Demand Framework helps teams design demand around how buyers actually buy.

Strong demand gen creates demand, captures demand and moves readiness over time.

Start by tagging your current plan by readiness and creation vs capture. The gaps show what to fix first.

How We Market vs How Buyers Actually Buy

Inside your organisation, everything looks linear.

- Quarters

- Campaigns

- MQL targets

- Dashboard swings

- But buyers move differently.

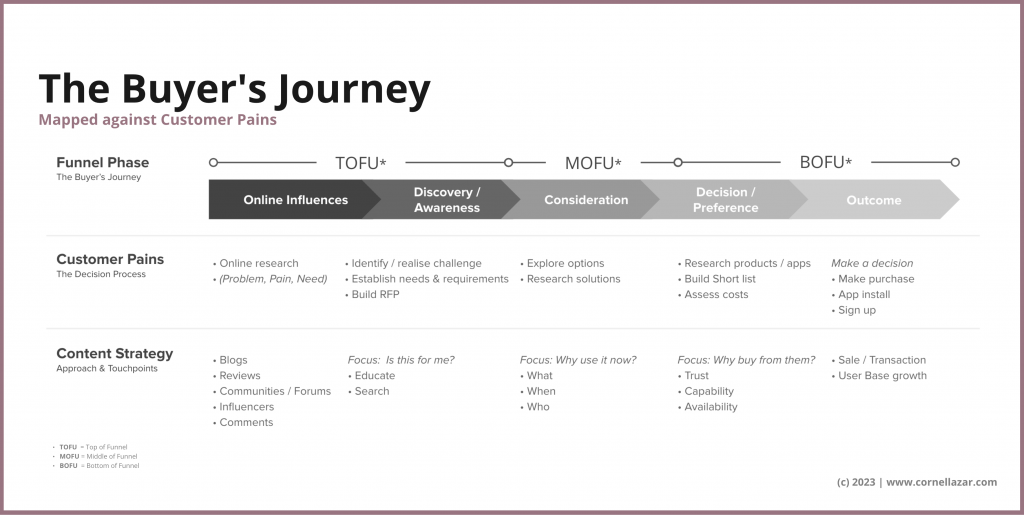

Internal debates, Slack groups, backchannel advice, late-night workaround spreadsheets, budget shuffles, shifting priorities. By the time someone reaches your site, they’re often well into their internal decision loop, not at the neat top-of-funnel stage your dashboard suggests.

This mismatch is at the root of most demand headaches.

You’re marketing to a funnel.

They’re buying in loops.

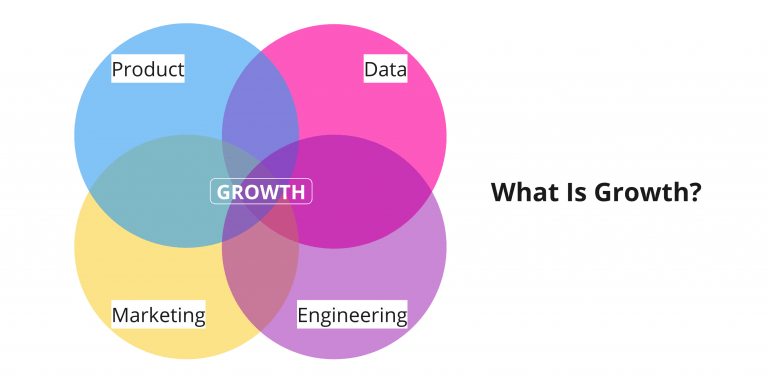

What Demand Generation Should Really Do

Demand gen has three jobs:

- Create demand: shape understanding and preference long before a formal buying cycle begins.

- Capture demand: make it easy for in-market buyers to find you, evaluate you and convert.

- Move readiness: help buyers progress from low → mid → high readiness through clarity, education and timing.

Lead gen counts leads. Demand generation counts clarity, intention and timing.

Cornel Lazar

The framework exists to make those three jobs visible and usable.

The Readiness Model – move from 95/5 a more Useful 10/30/60

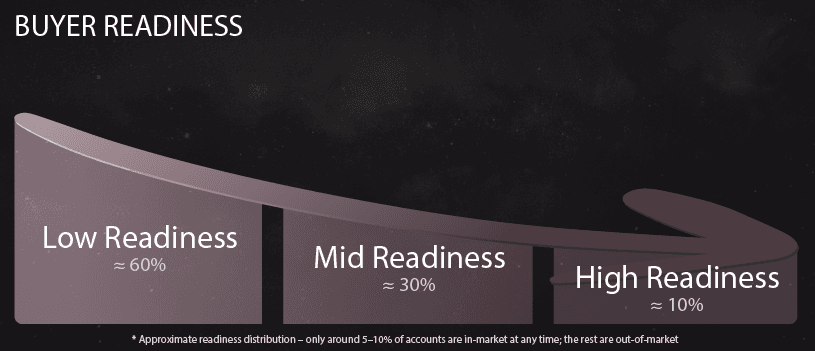

The 95/5 rule is widely referenced: roughly 5% of accounts are in-market, actively buying. The other 95% are out-of-market.

Based on research by Ehrenberg Bass and the LinkedIn B2B Institute, the 95/5 rule is certainly useful, but a bit too simple.

My Buyer Readiness Demand Framework expands on it by breaking it into a more actionable mental model:

Low readiness (around 60%)

Friction is present but undefined. The problem hasn’t yet crystallised into a project.

Mid readiness (around 30%)

The problem is understood. Buyers explore approaches, trade-offs and internal alignment. They’re comparing ways to solve it, not yet vendors.

High readiness (roughly a tenth of your ICP, overlapping the familiar “5% in-market” idea)

Teams are aligned internally and want detail, proof and a simple path to talk to sales.

These are not precise numbers, and they shouldn’t be treated like them. They exist to help you size your opportunity and rebalance effort.

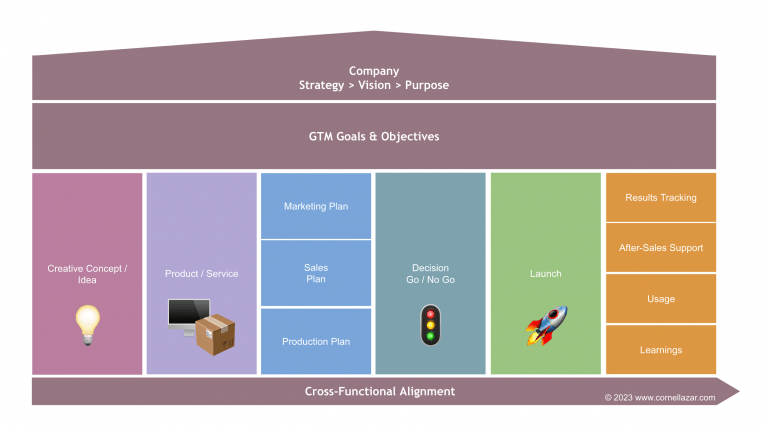

Not a Funnel but a GTM Operating System

Most frameworks become static diagrams. The Buyer Readiness Demand Framework is designed to become a shared operating system for:

- seeing your market

- designing programmes

- setting expectations

- measuring progress

- aligning marketing and sales on buyer reality

At the core you’re doing three things: understanding readiness, creating demand and capturing demand.

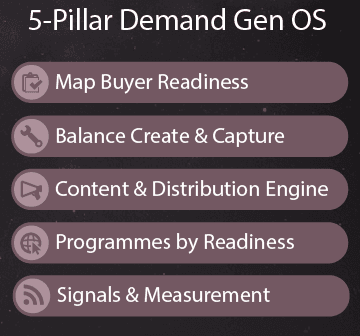

To make that practical, we break it into five usable pillars.

Readiness is not a score. It’s the shape of how buyers understand, compare and decide.

Cornel Lazar

The 5 Pillars

Each pillar is a lens, not a 20-page playbook.

Pillar 1 – Map buyer readiness

If your team can describe low, mid and high readiness in plain language, every GTM decision becomes easier.

Pillar 2 – Balance demand creation and demand capture

Creation builds tomorrow’s pipeline. Capture converts today’s. Both matter, but most teams overweight capture because it’s easier to measure.

Pillar 3 – Build a content and distribution system

A small, steady engine in the channels your buyers actually pay attention to will usually outperform a wide scatter of disconnected campaigns.

Pillar 4 – Design programmes by readiness layer

Stop treating all buyers the same. Build content and experiences that match where people actually are in their journey.

Pillar 5 – Measure creation, capture and readiness-shift signals

Your strongest leading indicators come from behaviour and questions – the signals that you’re creating demand, capturing demand and seeing more buyers show up at higher readiness.

What You’ll See When You First Apply This Lens

The first time a SaaS team tags its work by readiness and by creation vs capture, a consistent pattern appears.

Almost everything is built for high readiness

Demo CTAs. Paid search. Retargeting. Case studies. Product updates. All valuable – but aimed at the smallest group.

Mid readiness is thin

Very little helps buyers understand the landscape, compare approaches or build internal alignment.

Low readiness barely exists, yet it represents most of your future pipeline.

Almost nothing shapes the problem, challenges assumptions or educates the broader market.

This is why pipeline feels unpredictable even when lead numbers look good. You’re over-serving the smallest slice of your total addressable market.

A Realistic SaaS Scenario

Picture a mid-market SaaS company in its monthly pipeline review.

Marketing shares the highlights:

- MQLs hit target.

- Paid performance looks solid.

- Webinar sign-ups are up.

Sales counters:

- “Half the demos aren’t serious.”

- “We need more late-stage content.”

- “Opportunities are slow to progress.”

The CMO pulls up the readiness audit.

It shows:

- Most spend is in high-readiness capture.

- Very little supports mid readiness.

- Almost nothing speaks to low readiness.

They make a small, realistic plan:

- Add a narrative series for low readiness.

- Introduce a comparison guide and internal deck for mid readiness.

- Clean up pricing and product pages for high readiness.

Three months later, the dashboard looks different:

- Fewer MQLs.

- Better sales conversations.

- More qualified opportunities.

- More stable pipeline.

No restructure. No new headcount. Just a clearer way to see the market.

How to Start Small

You don’t need a six-month rebuild or a strategic offsite. You need a clearer lens and a few focused moves.

Step 1 – Re-label your current activity

Open your plan and tag each initiative by readiness and by whether it creates demand or captures it.

That simple exercise reveals more than most dashboards.

Step 2 – Agree your readiness signals

Sit with sales and define, on one page, what low, mid and high readiness look like for your ICP.

If you can name it together, you can start designing around it.

Step 3 – Make one small change per pillar

Not an overhaul. A nudge.

One narrative series for low readiness.

One mid-readiness resource that genuinely helps buyers move.

One improved conversion path for high readiness.

Incremental shifts compound quickly.

Step 4 – Watch the signals that actually matter

Move beyond form-fill volume and look for:

- Creation signals – repeat engagement, shares, deeper content consumption.

- Capture signals – higher intent on product pages, stronger demo behaviour.

- Readiness-shift signals – better questions, more informed conversations, fewer “who are you and what do you do?” calls.

These tell you whether your market is actually moving.

Common Traps

- Turning the framework into a pretty diagram instead of a working lens.

- Rebuilding activity but keeping the same skew towards high readiness.

- Celebrating MQL volume while pipeline quality stays flat.

- Overthinking attribution and under-reading behaviour.

- Trying to do everything at once instead of making a few meaningful shifts.

Why It Matters

When you stop seeing your market as a funnel of leads and start seeing it through buyer readiness, everything changes.

- Your programmes become clearer.

- Your pipeline becomes healthier.

- Your GTM team finally speaks the same language.

The Buyer Readiness Demand Framework isn’t a new tactic. It’s a better way to understand your market and act on it.