To achieve growth, it’s crucial to appreciate that growth is a journey, not just a destination. To move forward effectively, organisations must adopt a growth mindset rooted in data to make informed decisions and learn tactically along the way for continuous calibration and optimisation. For that, you need focusing on the most insightful growth metrics.

Measure what matters is not only the title of John Doerr’s ultimate book on OKRs, but also key to growth. Identifying and monitoring the correct key growth metrics and KPIs is crucial.

Let’s explore some of these Growth metrics and why measuring them is important.

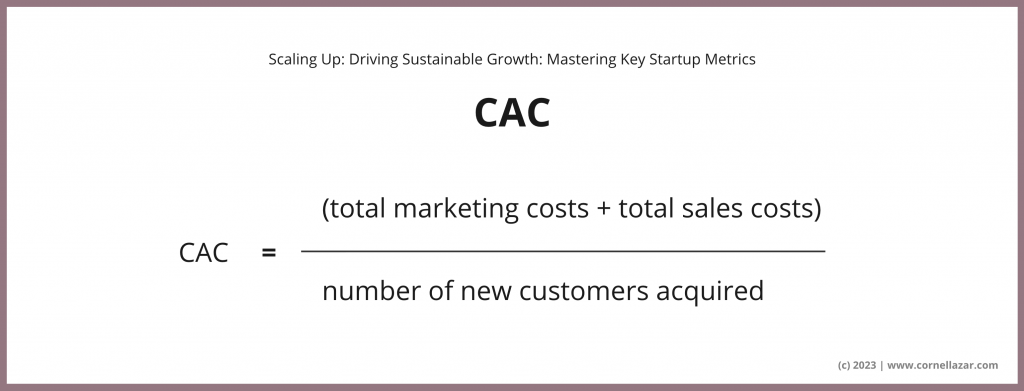

Customer acquisition cost (CAC)

CAC examines the total expenses for marketing and sales required to acquire a new customer within a defined timeframe (e.g., month, quarter, year). In this context, a customer refers to a new user who has made a purchase.

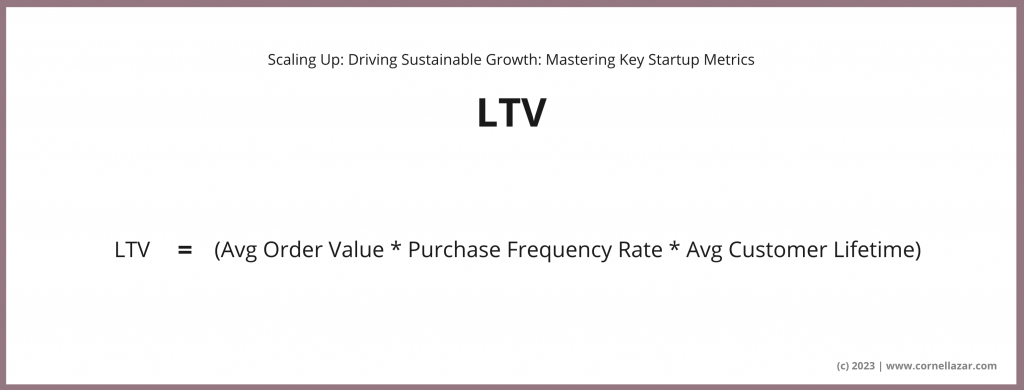

Customer lifetime value (LTV)

Your LTV indicates the expected revenue over the average lifespan of a single customer. Calculating LTV varies depending on your business, but a good starting point would be:

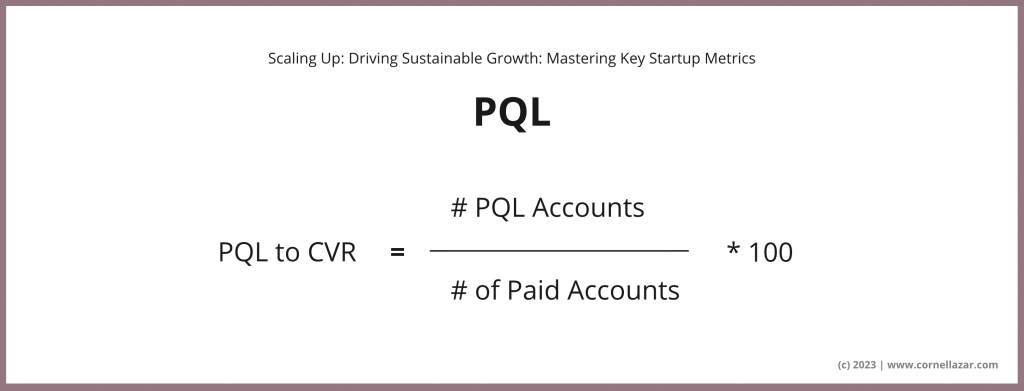

Product Qualified Leads (PQLs)

PQL and the PQL-to-Paid CVR are particularly relevant to product-led-growth (PLG) companies. A PQL represents a user who has experienced value from using a product, often through a trial or freemium model, limited feature access, or other firsthand experiences.

If you are a PLG company or considering transitioning to one, tracking and optimising these metrics is essential. Calculate your PQL-to-Paid conversion rate:

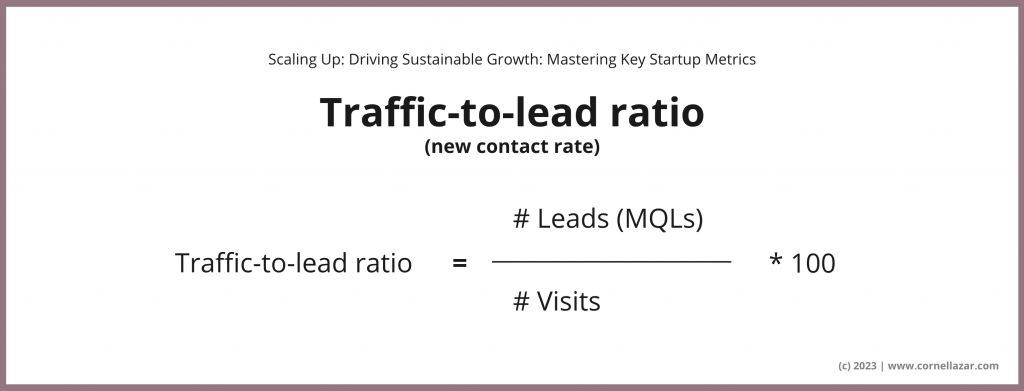

Traffic-to-lead ratio (new contact rate)

Understanding your website traffic is highly important. If your traffic remains steady or increases, but your traffic-to-lead ratio is low or decreasing, it’s a clear sign that something on your page needs optimisation or addition. This could range from your messaging to user experience or the implementation and review of your lead magnet.

The formula is essentially the visits to MQL (leads) conversation rate.

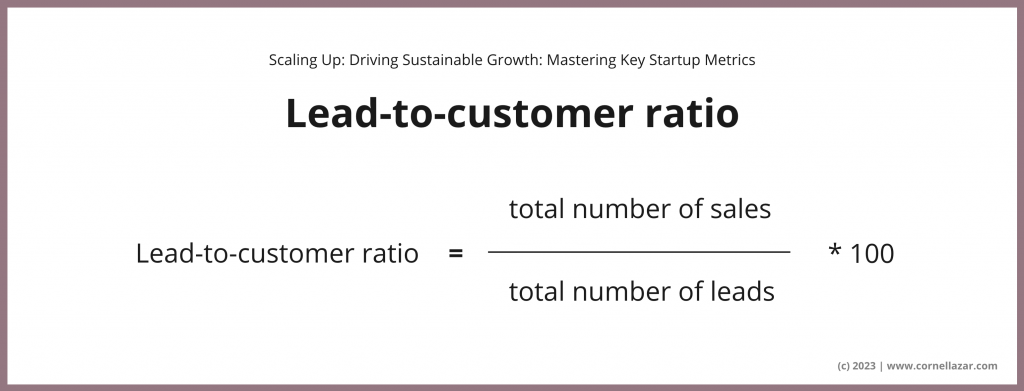

Lead-to-customer ratio

This metric reveals how many leads the sales team successfully converts into customers. However, driving SQL performance is not exclusive to the Sales Team. Growth teams want to get a full-funnel view and conduct a cohort analysis. Are you targeting and acquiring the best leads? Does the lead scoring system need calibrating? Calculate both your sales qualified lead (SQL) conversion rate and sales accepted lead (SAL) conversion rate.

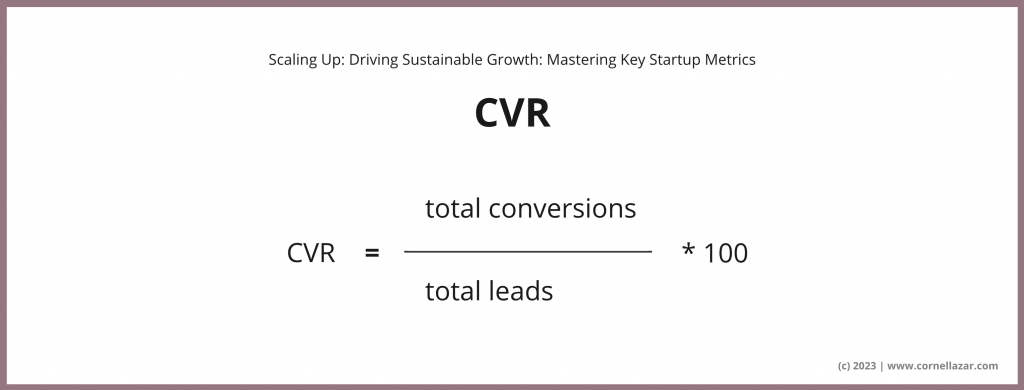

Conversion Rates (CVR)

Every time a user progresses from one touchpoint to the next, it counts as a conversion. The general use of CVR as a primary metric is in the context of landing page conversions, where it measures how many users or leads at the bottom of the funnel make a purchase through the website or app.

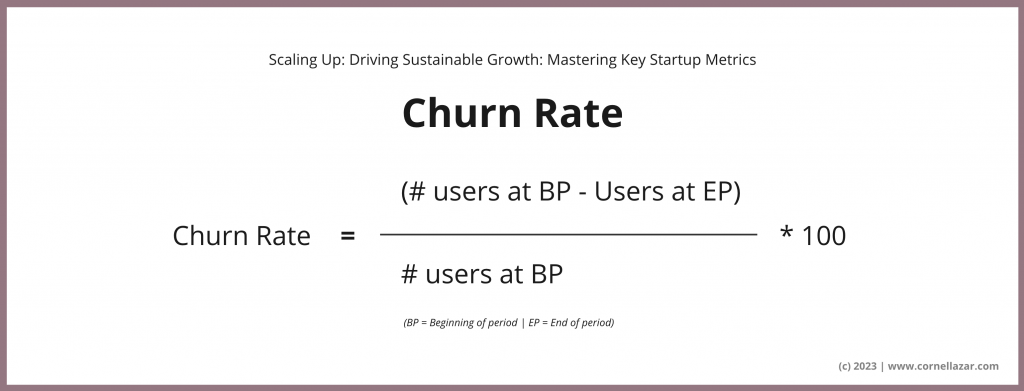

Churn Rate

This metric represents the percentage of users who didn’t renew paying for a product within a specific time period.

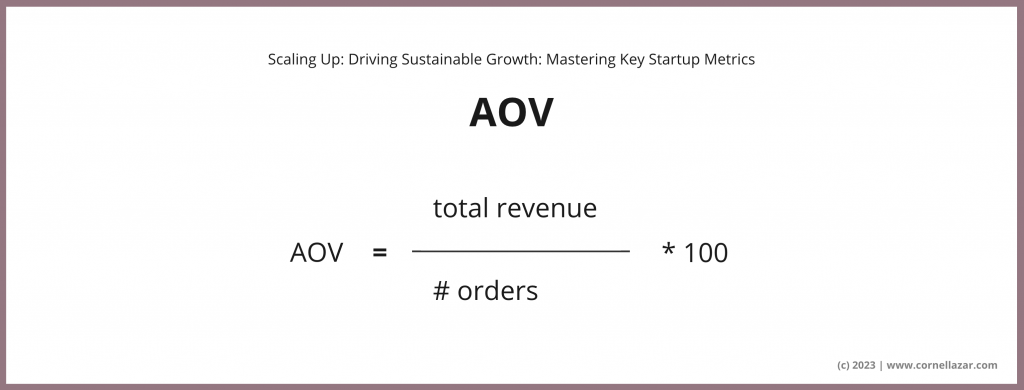

Average Order Value (Average Basket Size)

It indicates the average amount a customer spends per order on your product or website. To calculate Average Order Value (AOV), divide the total revenue by the number of orders.

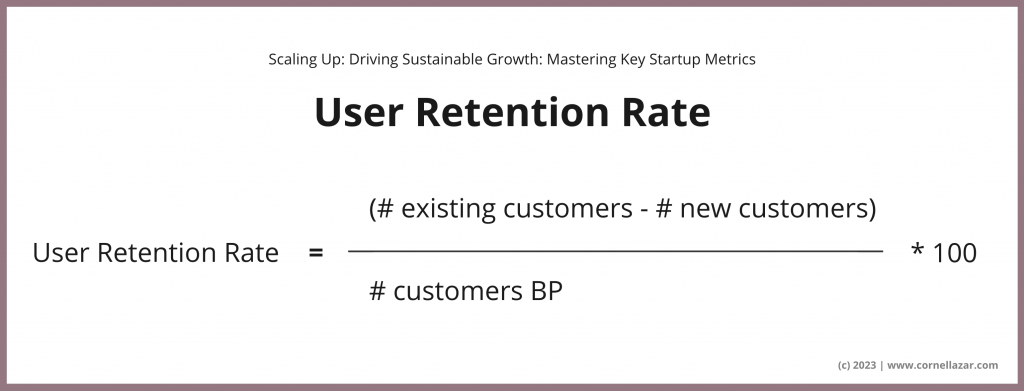

User Retention Rate

This percentage reflects the number of users continuing using the product and measured after a specific date.

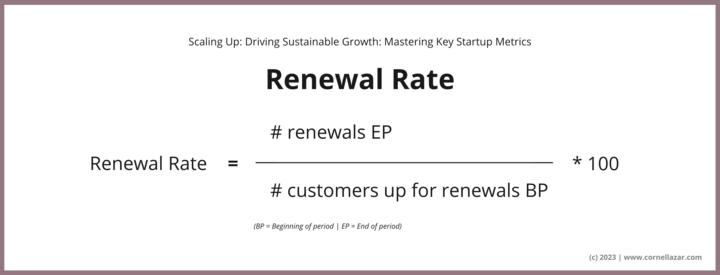

Renewal Rate

Users renewing a subscription and continue using your product. Measured in percentage and from the end of their subscription period.

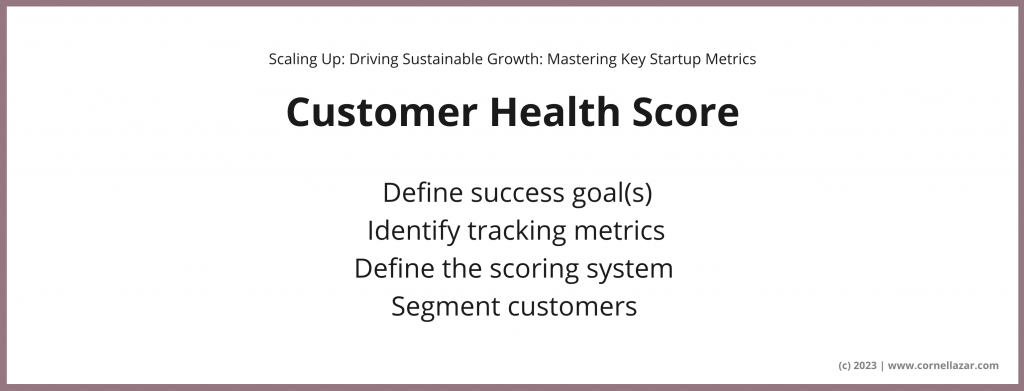

Customer Health Score

A Customer Health Score determines whether customers are happy using the product or service or at-risk of lapsing or churning. The scoring system will greatly vary from company to company but it always combines multiple indicators, such as usage, satisfaction, and support interactions.

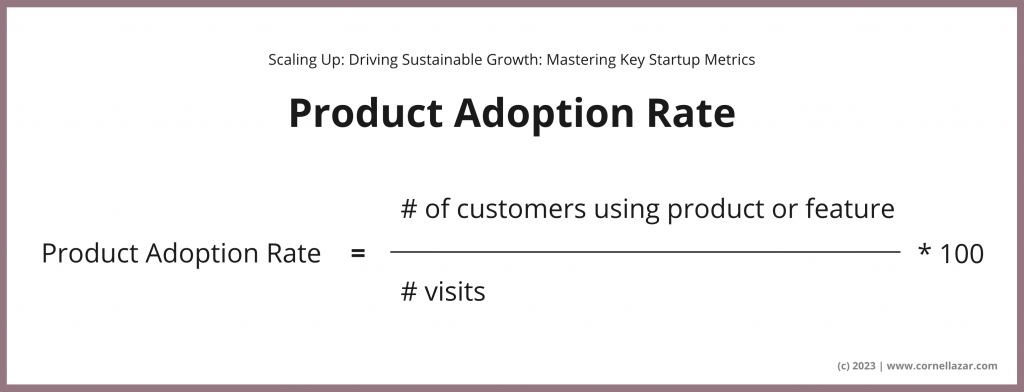

Product Adoption Rate

How fast are your users adopting your product or specific features? The Product Adoption Rate is a cross-functional metric but generally owned by Product Marketing as part of a GTM strategy. Measured as a percentage within a timeframe following its release.

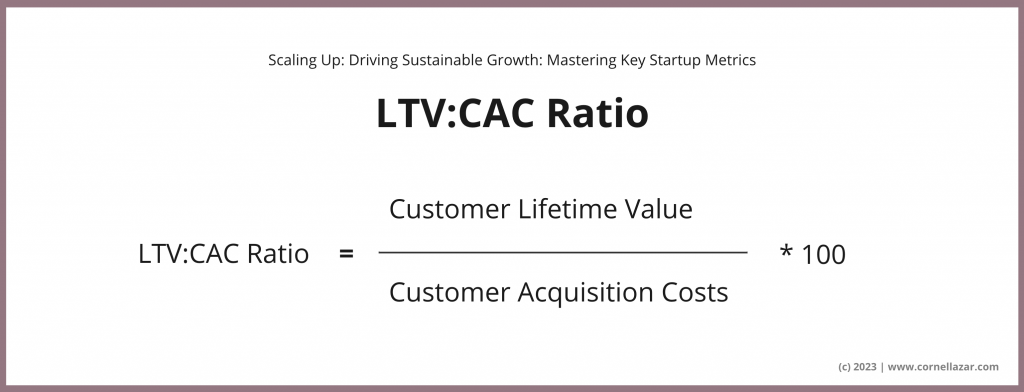

LTV:CAC Ratio

The LTV:CAC Ratio is one of your most important metrics. It tells you how much you spend per customer and how much money you make from each customer.

The LTV:CAC ratio is calculated by dividing your LTV by CAC. LTV:CAC is a signal of profitability. Rule of thumb is to aim for a LTV:CAC ratio of 3x or higher before considering to scale. 3:1 or above. This means, for every £1 spend on acquiring a new customer, you are making £3 or more.

Crucial caveat: Pre-PMF startups should not optimise to LTV:CAC and instead focus on getting your product in front of customers and get feedback.