Introduction: Why ICP Matters

Most SaaS companies believe they know their ideal customer. Few have defined it rigorously. The result: wasted spend, low win rates, and long sales cycles.

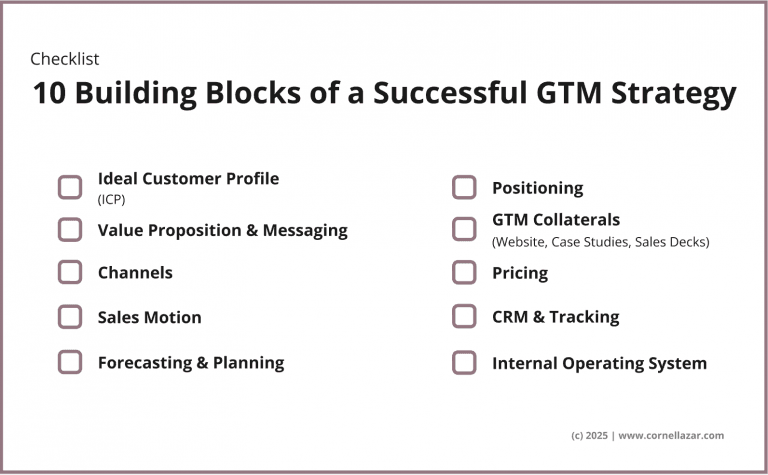

Your Ideal Customer Profile (ICP) is not a “nice-to-have.” It is the foundation of your entire go-to-market (GTM) strategy. Without it, every other initiative – inbound, outbound, account-based marketing (ABM), enablement – risks misfiring.

Many teams confuse ICP with “persona” or “segment.” That mistake dilutes targeting and produces generic messaging. A precise ICP anchors everything else.

What an ICP Is (and Isn’t)

Before building, we need to clear up the vocabulary:

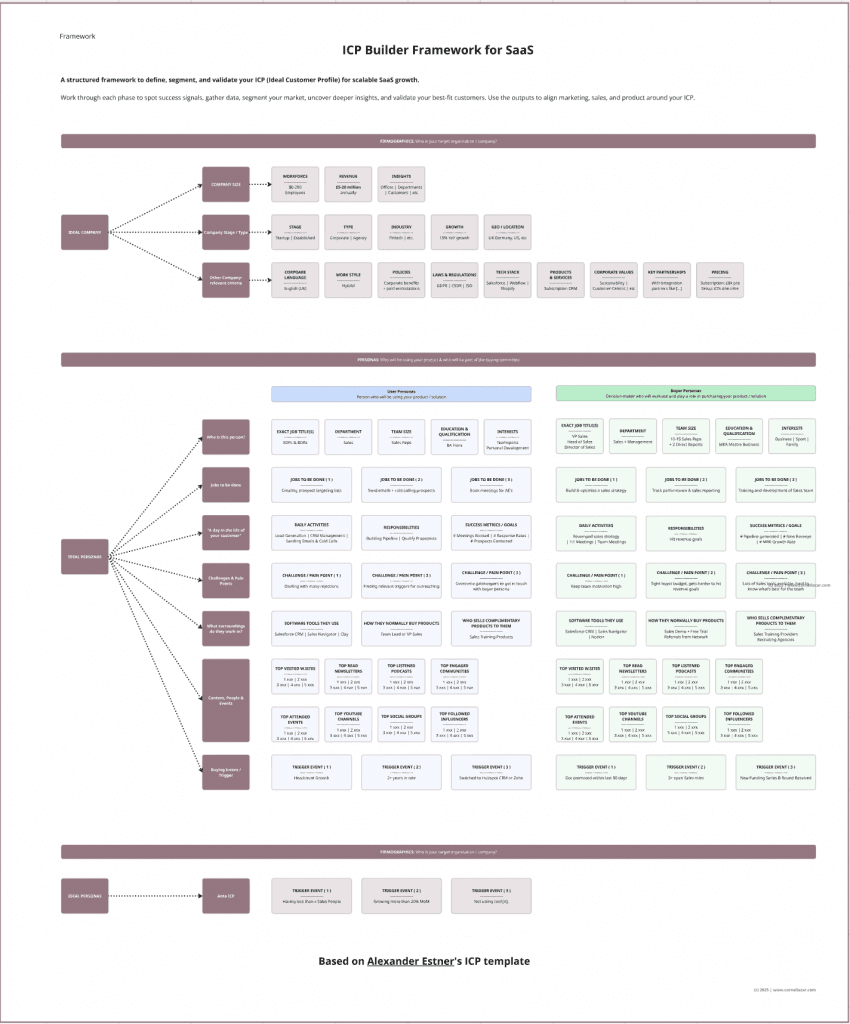

ICP (Ideal Customer Profile): The type of company you sell to. Defined by firmographics (attributes such as company size, revenue, industry, and geography) and technographics (tools and platforms in use, e.g. CRM, ERP, cloud).

Persona: The people inside those companies who evaluate, buy, or use the product – for example, the Head of IT, CFO, or Operations Manager.

Segment: A broader slice of the market with shared attributes – for example, “mid-market fintechs in Europe.”

👉 Quick test: if you can’t describe your ICP without mentioning personas, you haven’t defined it properly.

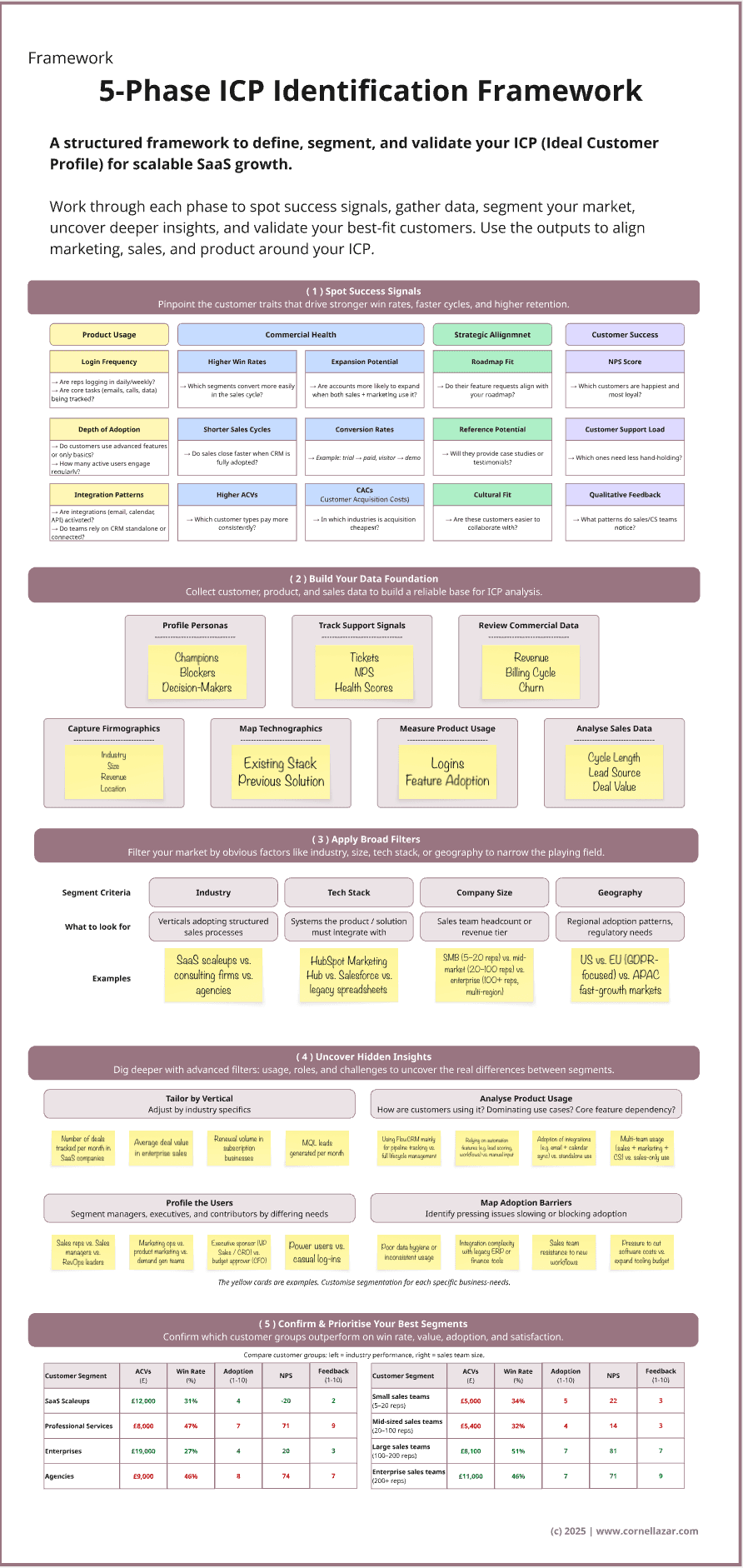

Phase 1: Spot Success Signals

Ask yourself: which traits separate customers who thrive with you from those who churn quickly? Look for four categories of fit signals:

Commercial health → Do these customers deliver higher contract values (ACV), renew more often, or expand faster?

Product usage → Are they logging in daily, adopting advanced features, and using integrations?

Strategic fit → Do they align with your roadmap, have reference value, or match your target verticals?

Customer success → Which customers show the best outcomes with the least support burden?

For a deeper look at the behavioural and fit signals that separate high-fit accounts from the rest, explore my article, How to Find Your ICP: Signals That Matter.

You cannot define an ICP without evidence. Data comes in three layers depending on your company’s stage:

Quantitative (data-rich SaaS): CRM reports, win/loss analysis, product usage analytics, support metrics.

Qualitative (insight-driven): Customer interviews, sales anecdotes, CSM observations.

Scrappy alternatives (early-stage): Founder notes, LinkedIn searches, competitor case studies.

👉 Whether you have thousands of customers or just your first ten, you can always start. The question is what signals are available to you today?

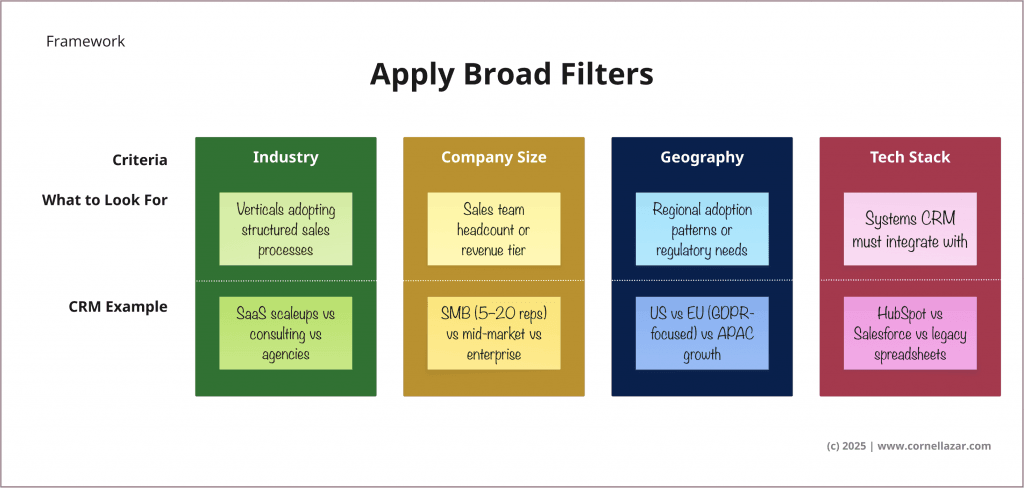

Phase 3: Apply Broad Filters

Use simple, surface-level filters to quickly narrow the total market into manageable groups.

What this means?

At this stage, you’re not chasing depth – you’re cutting down the universe into obvious categories that help you see patterns faster.

Think of it as “buckets” to sort accounts before doing deeper analysis.

Typical filters include:

Industry: Which verticals are adopting structured sales processes?

Company Size: By headcount, revenue bands, or sales team size.

Geography: Regional adoption patterns or regulatory environments.

Tech Stack: Which tools must your solution integrate with?

Broad filters are useful, but firmographic filters alone are weak predictors of true ICP fit. I explain this in more detail in How to Find Your ICP: Signals That Matter.

👉 These filters don’t give you the best ICP yet. But they remove the noise and focus your analysis.

Phase 4: Uncover Hidden Insights

Go beyond surface attributes to spot the deeper signals that separate average-fit customers from great-fit customers.

What this means?

Broad filters only give you the outline. Hidden insights tell you how customers behave inside those groups – which helps you pinpoint the segments that will scale best with your product.

Deeper signals to look for:

Tailor by Vertical: What industry-specific metrics really matter? (e.g., deal volume in SaaS, billing complexity in services).

Analyse Product Usage: Are accounts relying on just one use case, or expanding into multiple?

If you want a step-by-step ICP framework that turns this use-case thinking into a full process, see ICP for SaaS: A Practical Framework.Profile the Users: Who are the champions, blockers, and budget-holders in each segment?

Map Adoption Barriers: Where does rollout stall? (data hygiene, integration challenges, resistance to change).

Phase 5: Confirm and Prioritise Your Best Segments

Now use your data to confirm which customer groups outperform. Look at win rates, ACV, adoption, and satisfaction across different cuts.

Industry view: SaaS scaleups vs professional services vs agencies.

Size view: Small teams (5–20 reps) vs mid-market (20–100) vs enterprise (100+).

👉 Practical validation tools:

Customer advisory boards: stress-test assumptions with trusted clients.

Pilots and POCs: run controlled trials with ICP candidates.

Sales feedback loops: embed ICP checks into win/loss reviews and deal debriefs.

I also outline ICP tiering and anti-persona thinking in How to Find Your ICP: Signals That Matter.

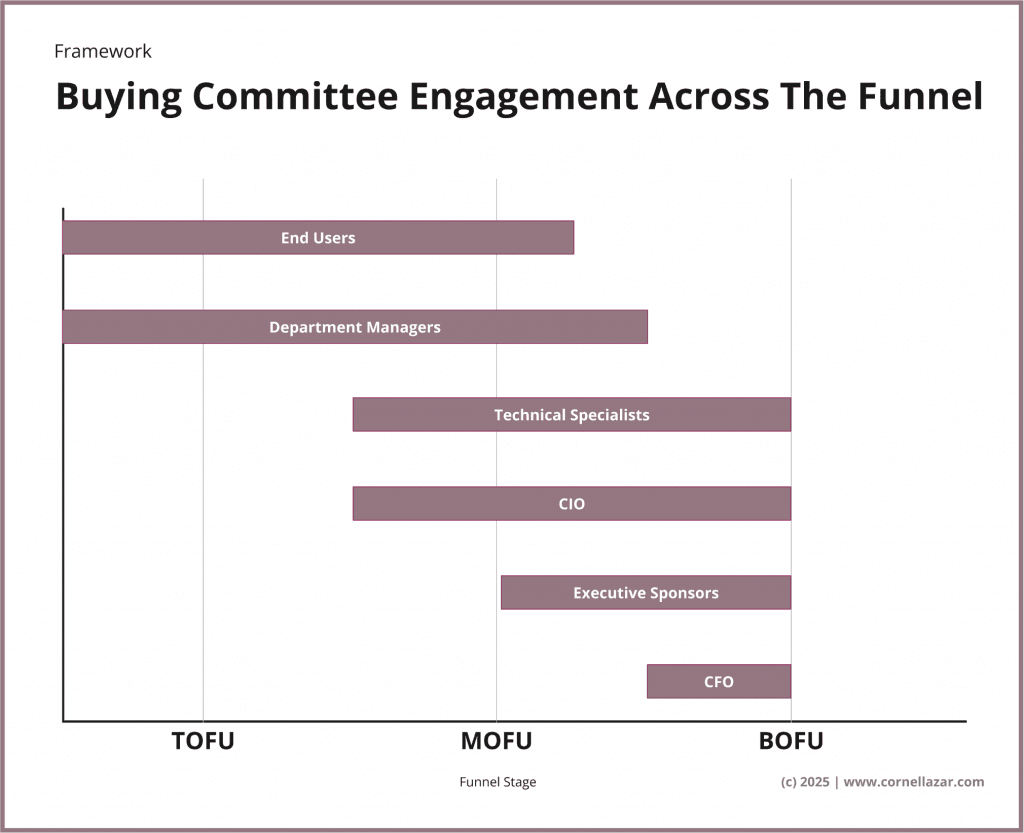

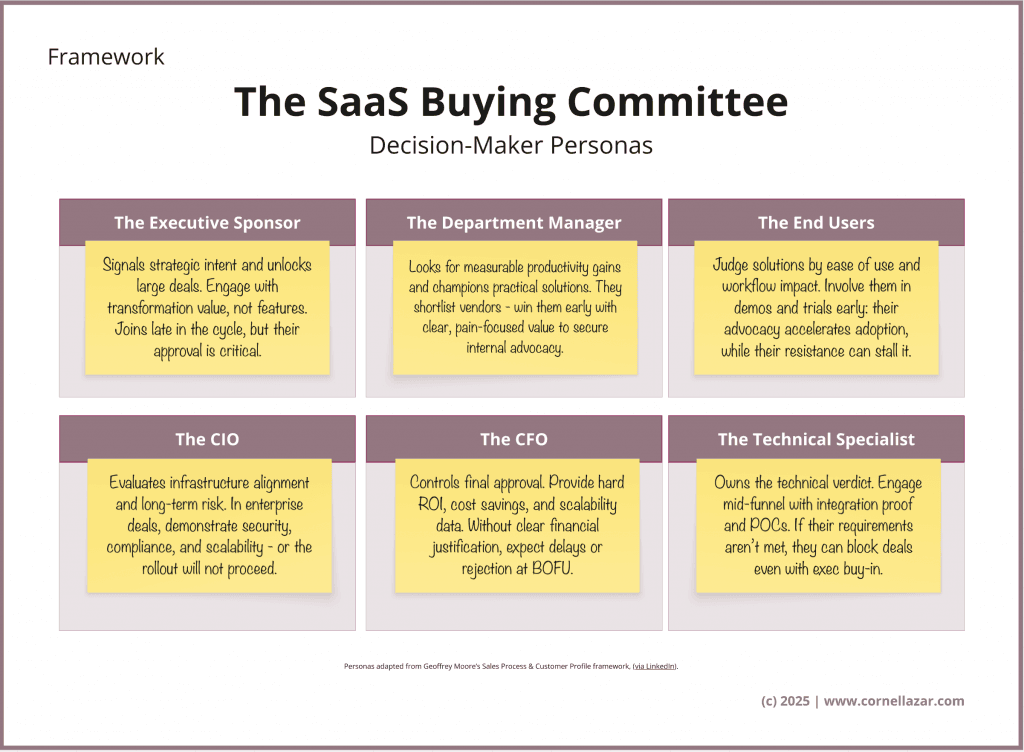

Mapping Personas to the Funnel

Identifying the company is only half the ICP equation. You must also map the buying committee.

End Users (TOFU → MOFU)

- Join early via demos and trials, validate usability, can become champions or blockers.

Department Managers (TOFU → MOFU)

Respond to outbound, evaluate pain relief, drive internal advocacy.

Technical Specialists (MOFU → BOFU)

Validate integrations, run pilots, block deals if requirements fail.

Executive Sponsors (Late MOFU → BOFU)

Strategic alignment, budget approvals, transformation focus.

CIO (MOFU → BOFU, Enterprise)

Approve enterprise-wide adoption, care about scale and compliance.

CFO (BOFU)

ROI-focused, controls final spend.

👉 Different roles tend to appear at different funnel stages. Map your messaging accordingly.

Codify with Firmographics and Personas

From theory to playbook: document your ICP with structure and consistency.

Firmographics: size, revenue, industry, geography.

Technographics: current stack and required integrations.

Personas: user vs buyer, their jobs-to-be-done, pains, and influence level.

👉 This worksheet ensures every team (sales, marketing, product, Customer Success) works from the same ICP definition.

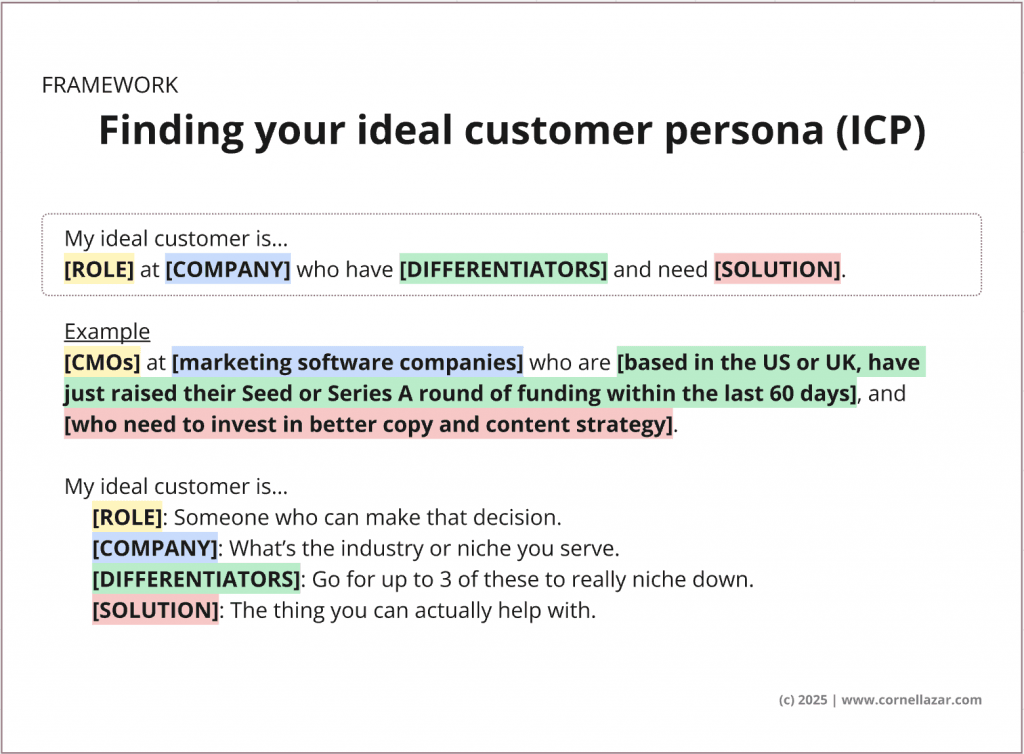

Crystallise with ICP Sentence

Once you’ve done the hard work, distil your ICP into a one-line statement:

Template: “[ROLE] at [COMPANY] who have [DIFFERENTIATORS] and need [SOLUTION].”

Examples:

Enterprise: “CIOs at multinational retailers struggling with legacy POS who need cloud-native solutions.”

Mid-market: “Ops leaders at fintech scale-ups expanding into Europe who need compliance automation.”

⚠️ Important: This is the output of rigorous analysis, not a shortcut. Writing an ICP sentence without data creates a generic, useless statement.

Operationalise Your ICP

An ICP is only valuable if you use it. Apply it across your GTM engine:

TAM sizing & account lists: Use ICP as the filter.

ABM tiers: Prioritise Tier 1–3 accounts by ICP fit.

Inbound content: Build messaging and SEO around ICP challenges.

Outbound plays: Personalise sequences to ICP attributes.

Sales enablement: Align battle cards and qualification (e.g. MEDDICC) with ICP.

Customer success: Tailor onboarding and expansion to ICP profiles.

👉 Tomorrow’s action: audit your last 10 won and lost deals against your ICP indicators. See which segment shows the best win rate and shortest cycle. Draft one ICP sentence for that segment and review it with sales.

Conclusion: ICP as a Living Compass

ICP work is not a one-off project. It evolves with your product, your data, and your market.

Your ICP is not a dusty slide deck. It is your GTM compass: revisit it quarterly, refine it with evidence, and use it to align every team. Companies that make ICP a living tool outperform those that treat it as a one-time exercise.

Glossary

ACV (Annual Contract Value): The average annualised revenue per customer contract.

NRR (Net Revenue Retention): A measure of revenue growth from existing customers after accounting for churn, expansion, and contraction.

MEDDICC: A qualification framework used in B2B sales (Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion, Competition).

Firmographics: Company-level attributes such as industry, size, revenue, and geography.

Technographics: The technologies and tools a company already uses (e.g. Salesforce, HubSpot, AWS).