Conducting a competitive analysis can assist in the decision-making process serving as valuable guide to positioning your brand and services, as well as fostering innovation in your product development and marketing strategy and tactics.

Revealing your strengths and weaknesses in relation to your competitors, the analysis will guide you identifying your distinctive market niche and support in planning your roadmaps.

Whether you have a market-ready product or just a rough idea scribbled on a napkin, conducting competitive analysis is a regular strategic element at any stage of a business.

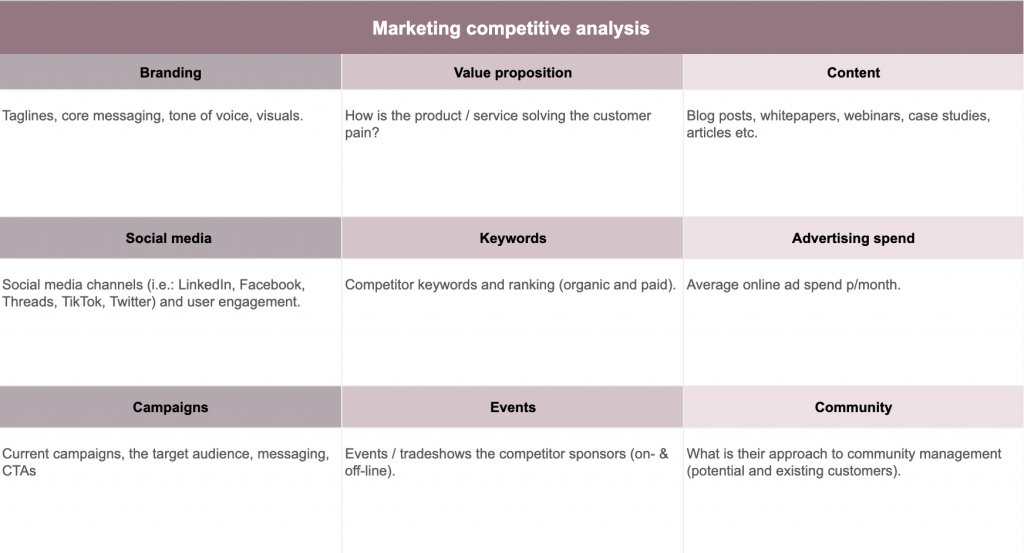

When approaching it from the perspective of Growth and Product Marketing, a competitive research generally maps your four P’s (product, price, place, and promotion) against your competitors.

How to Conduct Competitor Research and Focus on What Matters

The Purpose of Competitor Analysis

Conducting a competitive analysis serves as a valuable guide for positioning your brand and services. It also fosters innovation in your product development and marketing strategy and tactics.

Analysing your strengths and weaknesses in relation to competitors will help identify your distinctive market niche. It also supports planning product and go-to-market roadmaps.

Whether you have a market-ready product or just an idea, competitive analysis is a regular strategic element at any business stage.

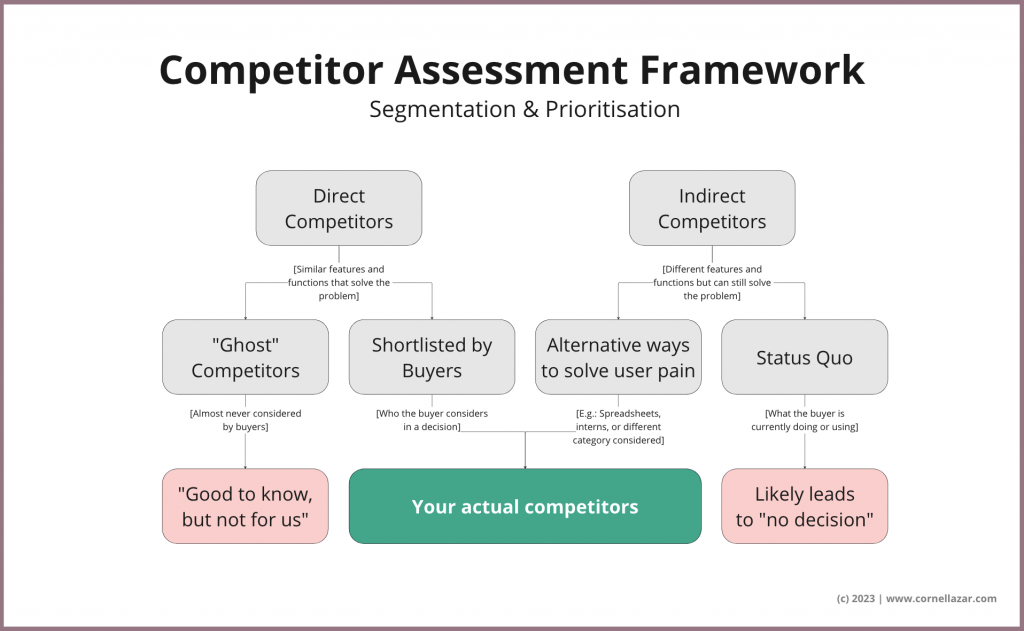

Avoid Common Pitfalls in Identifying Competitors

While a seemingly basic question, mistakes are easy to make at this stage. Don’t assume large global companies are competitors if they aren’t.

Equally, be aware of potential startup rivals which reminds of the how Blockbuster misread the future with Netflix.

Ask Three Key Questions to Identify Competitors

Startups often let their vision for disrupting whole industries cloud judgments of immediate challenges. Stay grounded in the current competitive landscape.

Avoid focusing on the wrong competitors by answering three questions:

- Who Are Your Target Customers?

Identify target customers or companies. Overlapping segments likely indicate competitors. - What Core Problem Does Your Solution Address?

If another company addresses the same problem, they are competitors. - What Is Your Product Approach?

If it aligns with another company’s, they are competitors.

Example: UK Ticket Resale Marketplaces

Assuming you are launching a new entertainment ticket resale marketplace. You may consider Ticketmaster and SeeTickets as obvious competitors but they aren’t your direct competitors.

Although they are major players and your startup has a lofty vision and big mission with the aim to reshape their space. However, most likely other startups and unregulated peer-to-peer platforms like Meta’s Facebook Marketplace or private WhatsApp groups can pose to be your direct and indirect competitor.

For example, competitors may include:

- Stubhub: Established ticket resale platform with global reach and large user base with a strategic partnership network.

- Twickets: UK ethical ticketing startup disrupting through tactical partnerships.

Meanwhile, indirect competitors include:

- Facebook “Marketplace”: No protections or verification for ticket sales.

- Craigslist: No marketplace protections or features.

- In person, fans selling tickets outside events

Conduct Thorough Competitive Research

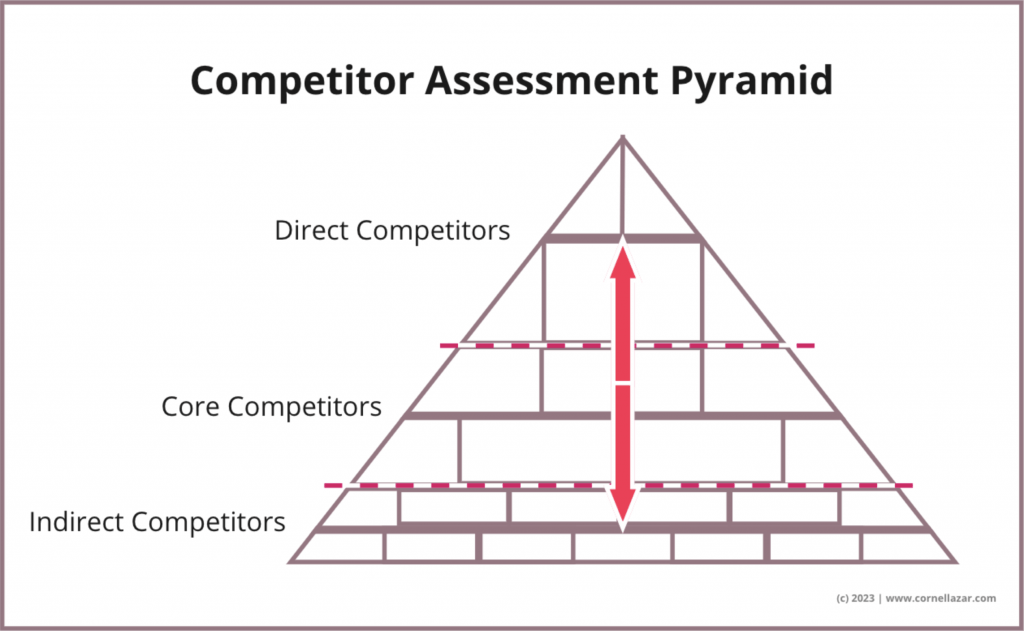

Fully grasp the landscape by exploring every facet. Identify direct and indirect competitors.

Direct competitors provide similar offerings targeting the same audience. Indirect competitors solve the same problem differently.

Use Google alerts, Crunchbase, SimilarWeb, and more to find competitors.

Never Speak Ill of Competitors

Avoid bashing competitors – you never know who’s listening. Reflects poorly on your character and credibility. This point doesn’t just apply to founders speaking to VCs, but should be weaved into your team’s mindset. Instead, highlight your differentiation. For example: “Competitor A does [XYZ], but we take it further with our [value proposition].”

Leverage Competitors' Success

If competitors recently got acquired or funded, showcase the market’s potential and urgency. Hint you might be next if you have that special something.

No investor wants to miss out. Emphasise your unique capabilities making you an attractive investment.

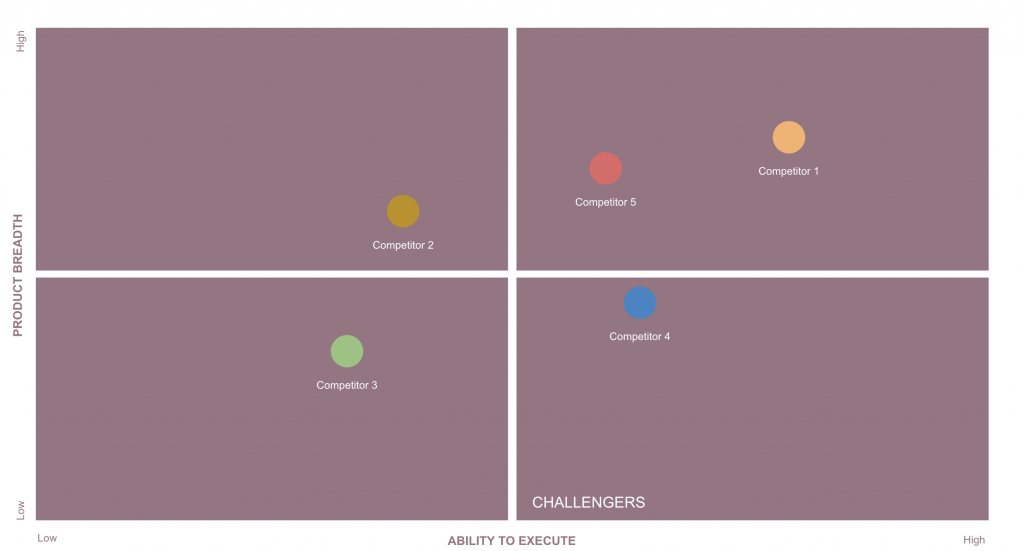

Visualise the Competitive Landscape

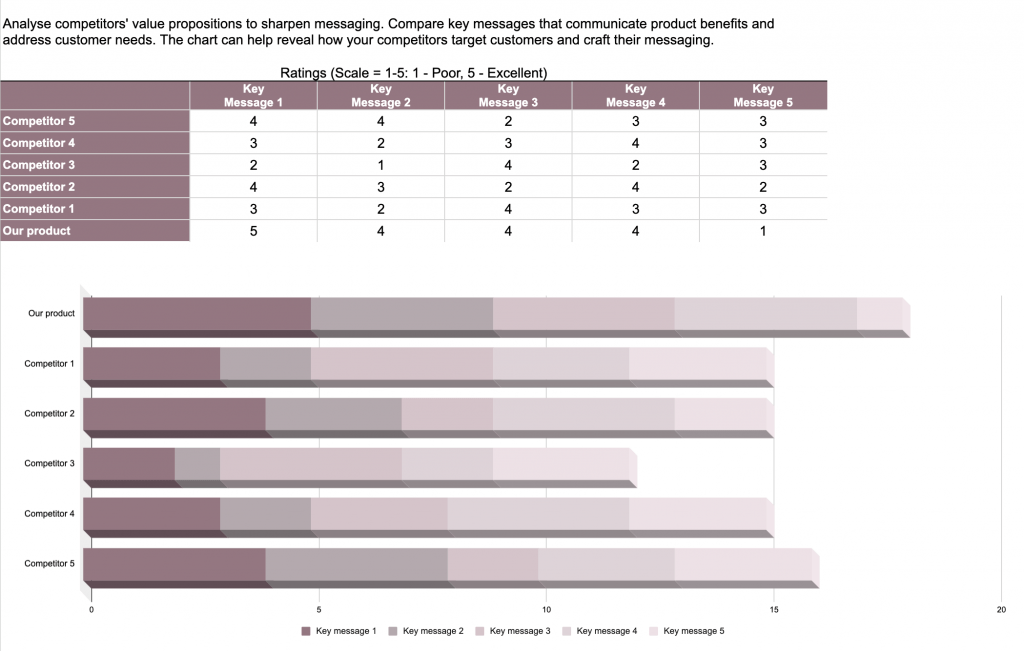

Don’t overwhelm with dense competitive analysis tables. Use at-a-glance visuals instead.

The Magic Quadrant

Popularised by Gartner, this measures you against competitors on two key metrics. Airbnb used Affordability and Online Transaction.

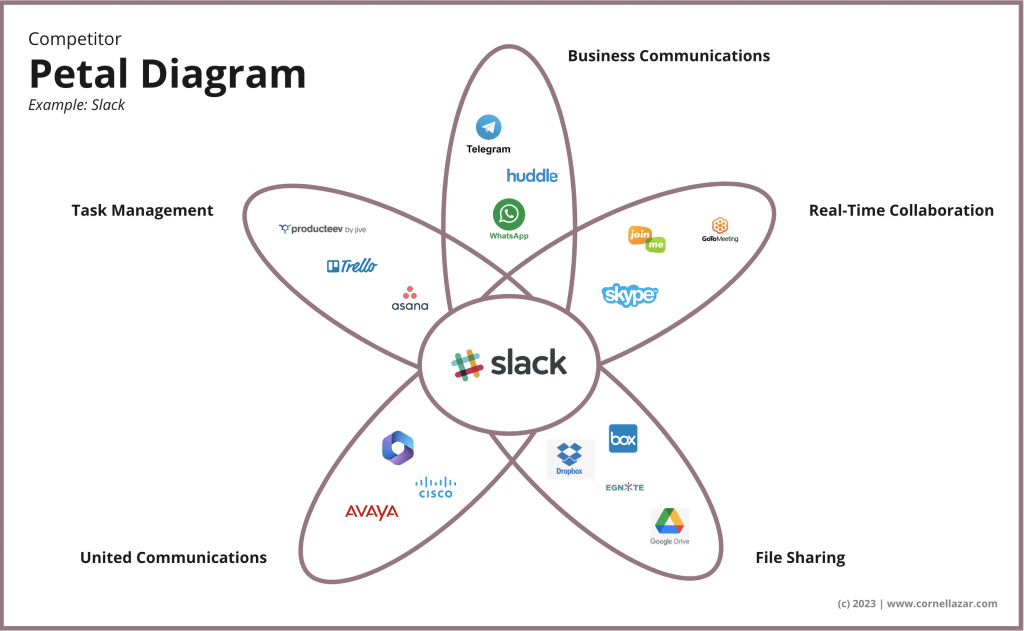

The Petal Diagram

Silicon Valley entrepreneur Steve Blank pioneered the Petal Diagram to evaluate competition when re-segmenting or creating markets. The key insight: Analyse adjacent categories to grasp differentiation, ideal customers, and position yourself in the ecosystem.

Your product at the centre is surrounded by competitor types representing aspects of your solution. My example shows 5 petals but use as many or as little petals as required.

Key Insights to Guide Strategy

Conducting analysis provides strategic insights to guide your startup’s success. Consider the following lessons:

Don't Obsess Over Competitors

While invaluable, don’t let competitors become your sole focus in product and marketing.

Instead, concentrate on your ideal customers – their goals, motivations, and challenges. Exceed their expectations and you’ll rise above competitors.

Focus on Relevant Competitors

Some direct competitors rarely make your buyer’s shortlist. Avoid fruitless battles where you’re not considered.

Monitor them for innovations and strategies – but don’t compete directly if buyers don’t see them as alternatives.

Address Customer Inertia

You don’t just compete with companies – you compete against customer inaction. Their path of least resistance is making no purchase at all. Failing to acknowledge this misses opportunities. Craft your messaging empathising with their inertia.

Presenting Your Competitive Analysis

You’ve conducted thorough research. Now share it effectively with stakeholders.

Know the Landscape Inside Out

Explore every facet of the landscape, from direct to indirect competitors. Set alerts, use databases, analyze sites.

Keep it Relevant and Focused

Some analyses contain endless cataloged details. Avoid info overload. Present focused insights tailored to stakeholders’ key questions.

Visually Convey Insights

Use visual formats like the Magic Quadrant or Petal Diagram instead of dense tables. Graphics communicate insights at a glance.

Tell a Compelling Story

Piece together a story from your research. For example, recent competitor acquisitions indicate surging market demand. Your unique approach positions you to capitalise on this.

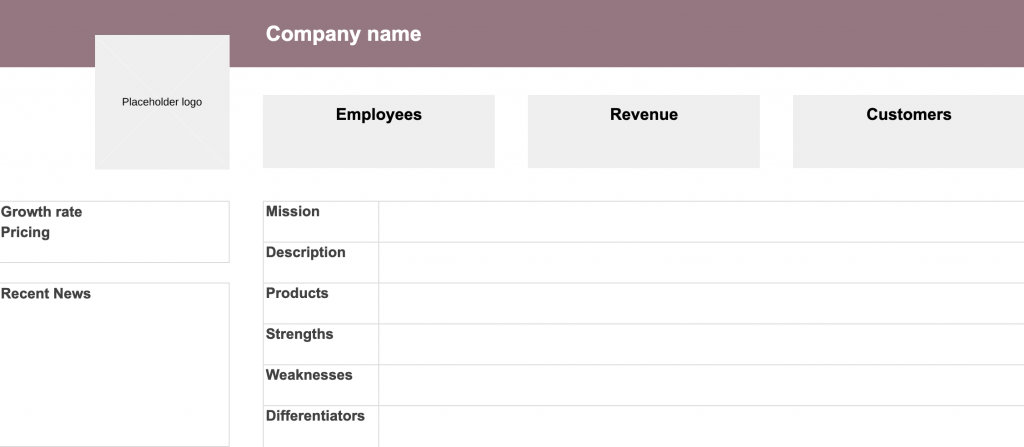

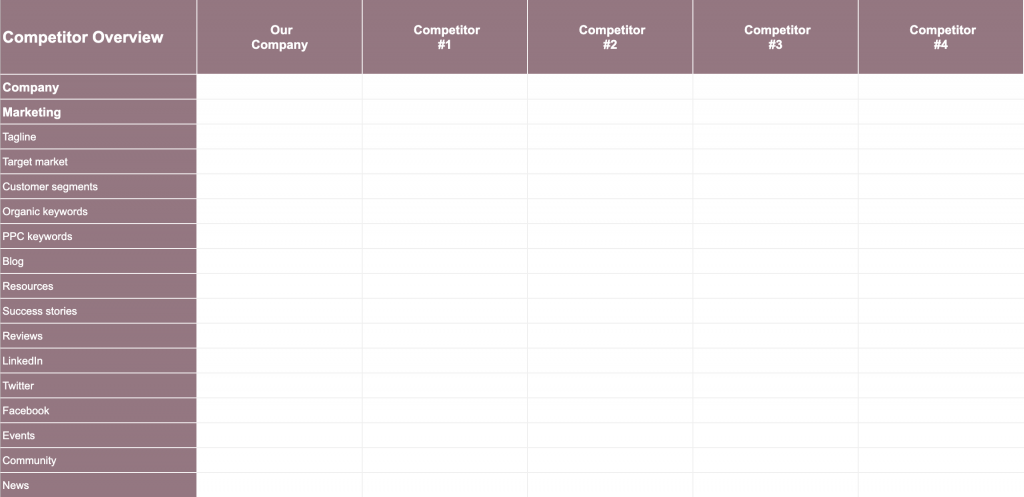

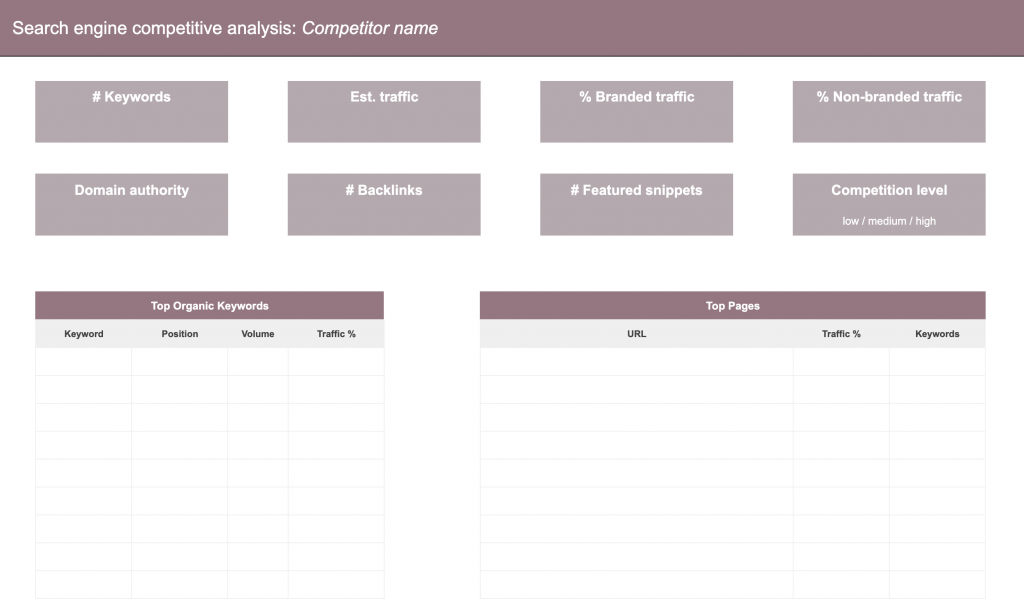

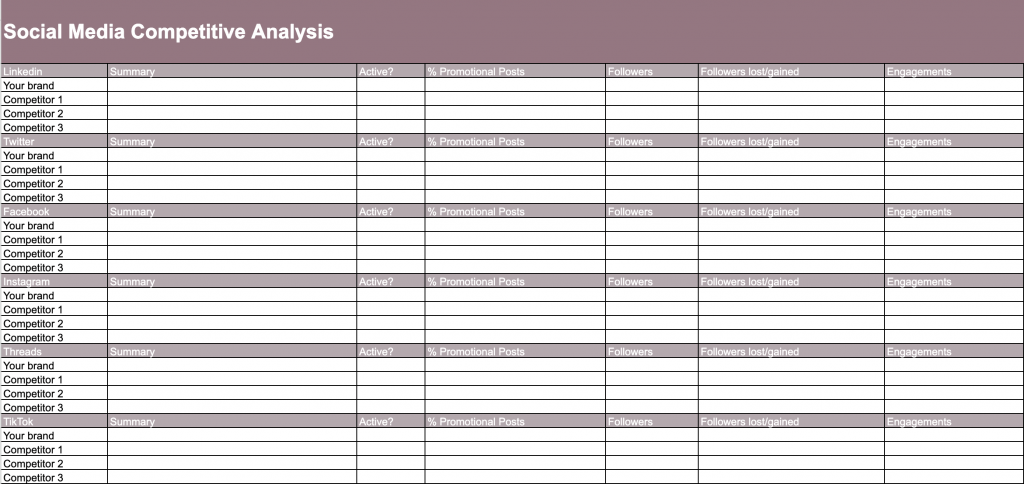

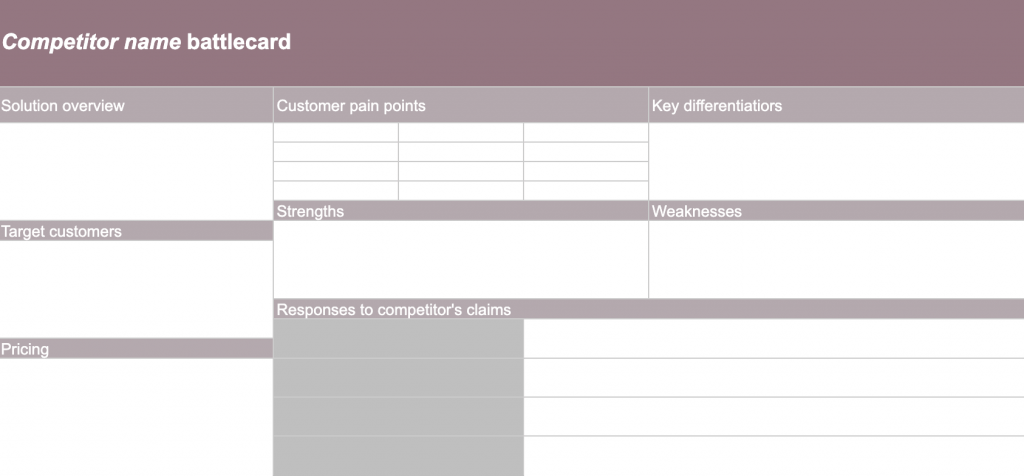

Resources: Competitor Analysis Template

Piece together a story from your research. For example, recent competitor acquisitions indicate surging market demand. Your unique approach positions you to capitalise on this.