Pricing your product in a way that aligns with its value is key to customer retention and profitability. Customers sign up for your product because it offers value, and they will continue to use it if they believe they are paying for a product that solves their needs.

Usage-based pricing has become increasingly popular particularly with SaaS (Software as a Service)companies where this approach ties monthly or annual costs to a customer’s use of the product, ensuring customers don’t churn.

In this post, I’ll explore how to define your value metric to ensure your pricing strategy is in line with the value your product provides.

What is usage-based pricing?

Before progressing, let’s align on the definition of user-based pricing.

Usage-based pricing ties pricing to the cost of a product to the customer’s usage. This pricing model is becoming increasingly popular in the SaaS industry.

The more a customer uses the product, the more they pay. This pricing strategy is effective because it aligns the price of the product with its value to the customer.

The cost of the product increases as the customer’s usage increases, ensuring that they are only paying for what they need.

Why usage-based pricing is important for customer retention and profitability

Pricing is a critical factor in customer retention. If your customers feel they are not getting enough value for the price they are paying, they will not continue to use your product and eventually churn.

Usage-based pricing ensures that customers are paying for what they need and getting the value they expect. As a customer’s business grows, so will their usage of the product, resulting in increased revenue over time.

The pricing strategy should always align with the product’s value to ensure that customers continue to use it and are willing to pay for it.

What is a value metric?

A value metric indicates the value a user perceives from a product. When getting it right, the price of the product corresponds inherently with the perceived value and remains of equal weight if the price gets lowered or raised. It can be a powerful support when setting pricing.

There are several dimensions where a value metrics can support your growth planning:

- Acquire new customers: Understanding what potential customers value helps refine marketing messages and target the right segments.

- Refine pricing: Seeing perceived value compared to price tells you if plans are over or underpriced. Adjustments can boost conversion.

- Identify upsell opportunities: Knowing what features bring most value lets you target relevant upgrade offers to each user segment.

- Drive customer satisfaction: If some customers don’t get enough value from a plan, you can add features or adjust pricing to close the gap.

- Develop the product: Focusing on features that increase value and willingness to pay ensures you build what matters most to customers.

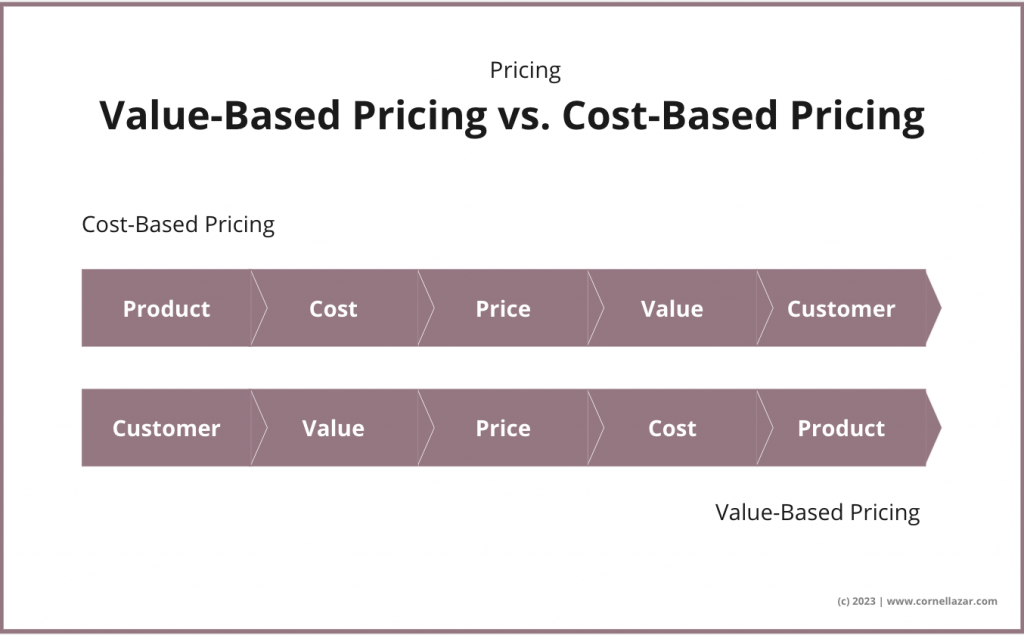

The SaaS pricing model has two main types of value metrics

Functional value metrics: They link price to customer usage of the product. Common examples are per user, per minute, per API call, or per project.

Charging per use encourages customers to fully utilise your product. But too much usage could exceed willingness to pay.

Outcome-based value metrics: Here price is connected to the outcomes achieved by using your product. For instance, income generated, clicks achieved, or storage used. Outcome metrics align pricing to the customer’s success.

The more value they gain, the more you can charge. However, some outcomes are hard to quantify or attribute solely to your product. Customers may not want to share sensitive data either.

A strong value metric for pricing has three key traits

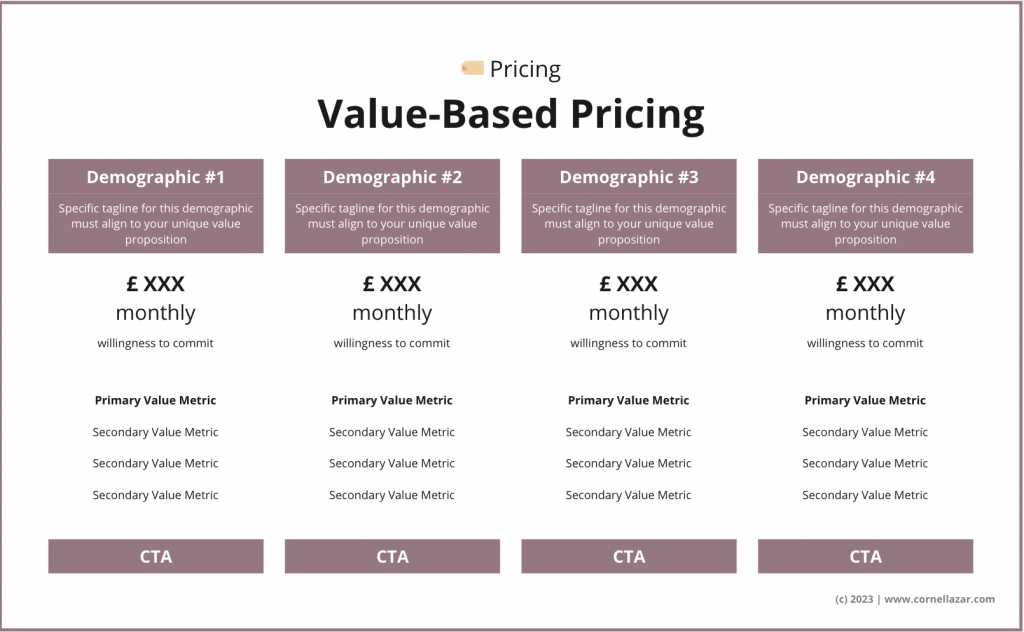

Pricing Plans that resonate: Your customer needs to perceive value that helps them with their jobs-to-be-done and pains. Your pricing and your different pricing plans must resonate or they will bounce very quickly.

Identify your product’s value drivers: X-ray your product for your core value drivers and build your metric on it. This is what you want to charge your customers for. Getting this wrong can lead to users to either “abuse” your freemium tier and never upgrade or they may never start using it in the first place. If you’re offering a free trial you could experience a high number of users never converting to the paid plan.

Scaling with your customer’s usage: Getting the value metric right that is aligned with your customer’s needs and their usage, you will accelerate usage and get commitment. Take for example a product where you would charge ‘per user’ would mean your revenue expands as the customer adds additional seats or users to their plan. Their growth becomes your growth!

In summary, an effective value metric is build on:

- Simple pricing and clearly defined plans.

- Value metric is tied to your product’s core value.

- Alignment means that you scale alongside your customer’s usage.

Getting this right incentivises customers to use your product to its fullest while getting real value. In this context, pricing is a key pillar that helps sustain growth for both you and your users.

Start with baseline metrics based on quant & qual data

Look at your value proposition canvas for your ideal customer and define their pains and job-to-be-done. Utilise quantitative and qualitative approaches.

You can super-simplify by breaking down your customer’s job-to-be-done into individual parts and answer the following questions:

- Does it align with my customers’ needs?

- Does it have appeal? Aka: Does it have strong value to my ideal customers as part of my acquisition and retention efforts?

- Can value and pricing be aligned to scale sensibly in a way that the customer is ready to pay more as their usage increases?

- Is it scalable?

Moving on to some required groundwork. Pull key baseline metrics that will help identify your target customers’ perceived value.

Quantitative baseline metrics

Track your primary metrics over a period of time to reveal how any pricing changes can impact your business. The core set of KPIs should include:

- Customer Churn Rate: High churn indicates low perceived value.

- Revenue Churn Rate: Dropping regular revenue can signal declining value.

- User Retention Rate: Good retention reflects strong product satisfaction.

- Monthly Recurring Revenue (MRR): Declines in MRR mean your value proposition is weakening.

- Customer Lifetime Value (CLV): This accounts for retention and ability to upsell. High CLV points to strong perceived value.

Length of period depends on your business, industry, etc. These metrics indicate whether your product delivers ongoing value at current prices. If one or more metrics fall short, you may have a value gap to address.

Qualitative data points

Your next step is to conduct a survey and for this exercise I’m proposing the Maximum Difference Scaling (MaxDiff) approach.

The MaxDiff survey asks customers to rate the most and least appealing parts or product features on a scale. This information will help you determine which parts of the product are most valuable to customers and should be tied to the pricing.

What is Maximum Difference Scaling (MaxDiff)?

Conduct a survey using Maximum Difference Scaling (MaxDiff) questions.

This survey asks customers to rate the most and least appealing parts or product features on a scale. This information will help you determine which parts of the product are most valuable to customers and should be tied to the pricing.

Maximum Difference Scaling (MaxDiff) is a market research technique used to understand customer preferences and identify the most important features of a product or service.

In MaxDiff, customers are presented with a set of items and asked to choose the most and least important ones from each set. By comparing the different sets of items and the choices made by customers, MaxDiff analysis can identify which features are most important to customers and which ones are least important.

This technique is particularly useful for understanding customer preferences when there are a large number of product or service features to consider.

MaxDiff analysis can also help to identify which features are most appealing to different customer segments.

Leveraging MaxDiff can be valuable for making pricing and product decisions that align your product with your customer needs.

How to define your value metric

To define your value metric, go back to your value proposition canvas for your ideal customer and define their jobs-to-be-done. Break down their jobs-to-be-done into individual parts and answer the following questions:

- Does it align with my customers’ needs?

- Is it scalable?

- Does it have appeal? In other words, does it have strong value to my ideal customers as part of my acquisition and retention efforts?

- Can value and pricing be aligned to scale sensibly in a way that the customer is happy to pay more as their usage increases?

How to identify your product's relevant value metrics?

To reveal your product’s value metrics I’m going to briefly talk through the following steps:

- Consider how your product is used

- Check usage patterns for different user segments

- Use surveys and interviews to learn where users see value

- Set limits for different user segments

- Measure and change as you grow

Let’s jump in.

1. Consider how your product is used

Value metrics relate to how your product gets used. For a SaaS collaboration tool such as Miro, value metrics could include the number of boards/canvases that can be created, number of collaborators per board, or premium integrations with apps such as Figma, Jira, etc.

Make a list of all the ways your product gets used to get value metric ideas.

2. Check usage patterns for different user segments

Look at usage data and compare your most and least engaged users by analysing their product usage across customer segments. Look into:

- Features they use or avoid. What are the loved features they use and and which are the ones they don’t care for?

- Usage frequency and intensity. How often and how long they keep using them?

- Goals achieved or missed. Have your users succeeded for what they initially signed up for?

- Map your product’s value along those lines

Who is who? And who does what?

Analyse product usage across customer segments through metrics like frequent use, the length they have been a customer, and high NPS (Net Promoter Score).

Study their feature use and apply the same approach for dissatisfied users. This will get you identifying:

- Power-users point to features driving high value

- Non-users highlight capabilities lacking value

- Frequency and intensity show engagement levels

- Goals indicate outcomes attained

3. Use surveys and interviews to learn where users see value

Surveys and interviews can more directly reveal value metrics. Extracting qualitative data points can also validate hypotheses from usage analytics. A recommended approach is using MaxDiff questions. Jump back to the section where I discuss how to apply MaxDiff for identifying your value metrics.

Surveys efficiently get data at scale by targeting specific segments. Deliver them in-product or through email. Interviews allow adjusting questions based on responses.

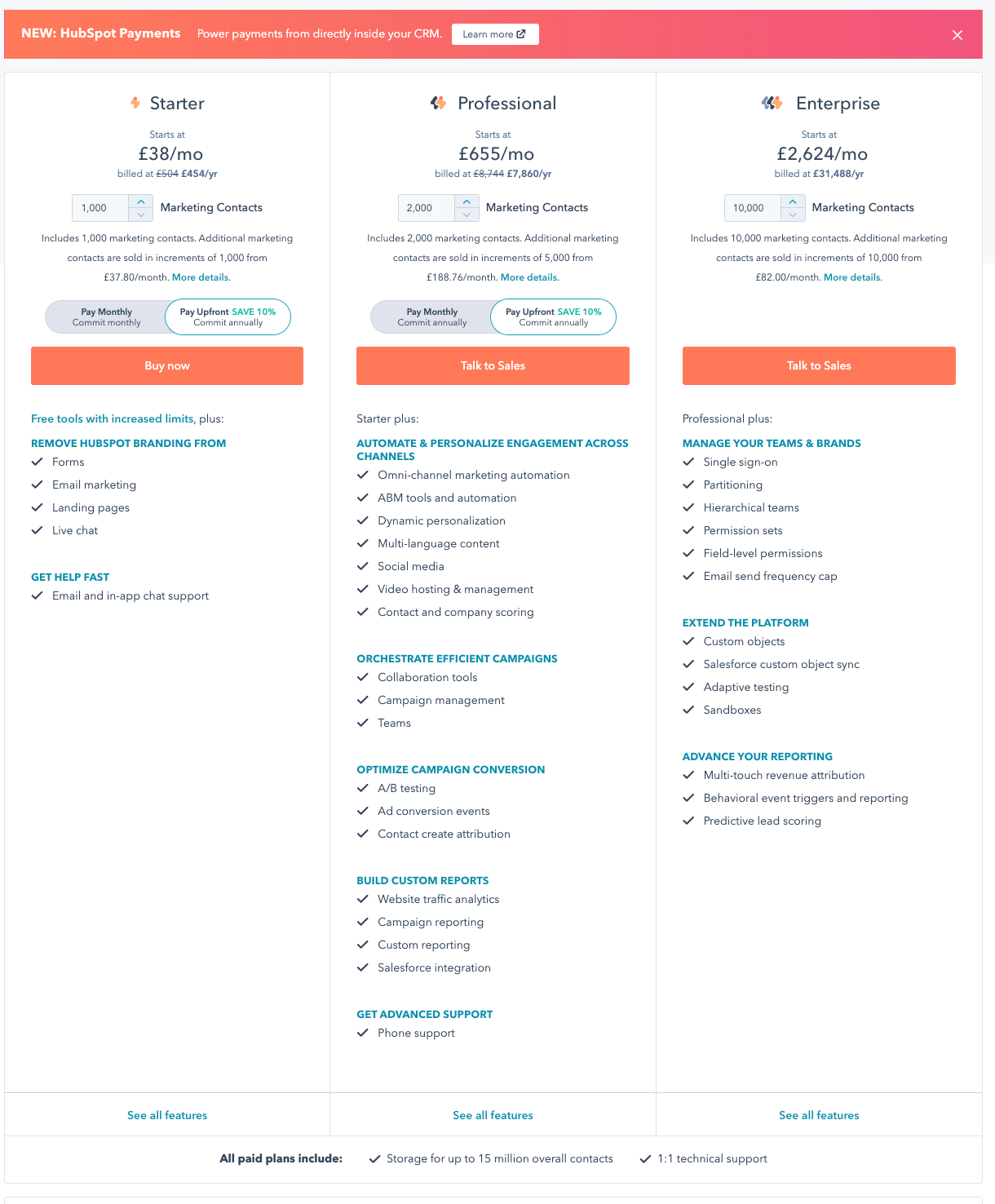

4. Set limits for different user segments

You can begin designing pricing plans when you have completed mapping key product features to your product’s primary value.

Your product’s value metrics are essentially your competitive defence – your main price differentiator! The challenge is setting usage limits. Users should see your product’s value while still want to upgrade. And that is even more so crucial with freemium models.

For instance, Miro caps free accounts to three boards, a limited template library and three collaborators per free account. If you require more boards and other features, you would need to upgrade to a paid plan.

You can also differentiate plans by extra non-core features that enhance user experience. For Miro that’s “find and share boards with unlimited project folders”.

Segment users and enable different features and limits for each.

5. Measure and change as you grow

When you starting out it can be a greater challenge to perfectly price plans when you are historic data poor. In this scenario be ready to clearly communicate internally that iterating is not only perfectly normal but will also give you the ability to learn and get data for modelling. Start tracking the same KPIs you used for your baseline, such as adjusting usage caps, etc.

Conclusion

As customers, we certainly have all benefitted from value metrics on the pricing plan pages of products we checked out – at the very least we experienced value metrics while using a product and being asked that a certain feature requires a paid upgrade; whether for private use in dating sites, music streaming apps and photo editing apps to our professional lives where you were able to trial a collaboration tool or email marketing platform but required to upgrade at a certain point of usage or when you required to unlock paid features.

You may also have been frustrated from badly build pricing pages that were not clear what the value metrics are concerned.

It cannot be overstated the crucial part value metrics play in customer acquisition and retention.

It’s vital to identifying your value metrics that resonate and differentiate before you start working on your pricing strategy. The result are pricing plans that match user expectations and perceived value while placing you competitively in the marketplace.

Get them right and you should see uplifts in your team’s acquisition and retention efforts.